Lösungen

Wir ermöglichen es unserer Kundschaft, in verschiedenen Regionen und über unterschiedliche Segmente hinweg erstklassige Banking- und Anlagedienstleistungen zu erbringen. Mit unserer umfassenden und flexiblen Plattform erfüllen wir regionale und aufsichtsrechtliche Anforderungen und passen uns an sich ändernde Rahmenbedingungen an. Dank unserer breiten Palette an Dienstleistungen und Implementierungsmethoden, wie On-Premises, Software as a Service und Business Process as a Service, werden wir jedem Geschäftsmodell gerecht.

Als verlässlicher Partner der Finanzbranche unterstützen wir Banken und Vermögensverwalter dabei, steigende Kundenanforderungen zu erfüllen und ihre Prozesse durch Automatisierung effizienter zu gestalten.

Regionale Kompetenz

Internationale Präsenz gekoppelt mit fundierter Kenntnis der lokalen Produkte und Vorschriften.

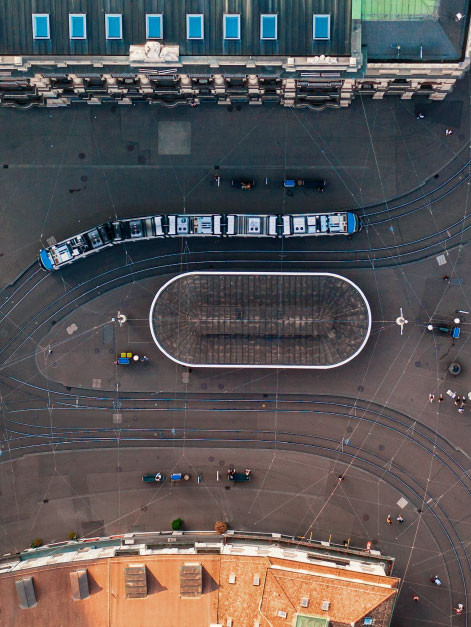

Unser Hauptsitz in Zürich ist die zentrale Anlaufstelle für unsere Kunden in der Schweiz und in Liechtenstein und bringt umfangreiche Expertise und Erfahrung im Bereich der Bank- und Vermögensverwaltungstechnologie in unser Angebot ein.

Mit unseren regionalen Standorten und Hubs im Vereinigten Königreich, in Deutschland und in Luxemburg sind wir europaweit präsent und können so die bestmögliche lokale Fachkompetenz gewährleisten.

Wir betreuen die Region Asien-Pazifik von unseren Standorten im Nahen Osten, Indien, Singapur, Hongkong, Australien und den Philippinen aus und haben lokale Teams in Japan etabliert. Unsere breite und vielfältige Kundengemeinschaft erstreckt sich jedoch über die gesamte Region.

Wir erweitern unsere Kundenbasis kontinuierlich in neue Märkte, die von unseren Produkten und Dienstleistungen profitieren können. Kontaktieren Sie uns und erfahren Sie, ob wir auch schon in Ihrem Markt tätig sind.

Segmente

Seit 1985 unterstützen wir Finanzinstitute bei der Betreuung diverser Kundensegmente.

Vermögensverwaltung und Private Banking

Wir decken die komplette Wertschöpfungskette der Vermögensverwaltung ab – vom Front- bis zum Backoffice. Dank leistungsstarkem Kundenmanagement verbringen Ihre Teams mehr Zeit mit Kundinnen und Kunden, während unsere Investment-Management-Lösungen hyperpersonalisierte Beratung in grossem Umfang ermöglichen.

Retail Banking

Bieten Sie Ihren Kundinnen und Kunden ein verbessertes Multi-Channel-Erlebnis – und senken Sie gleichzeitig Ihre Kosten. Unsere Web- und Mobile-Banking-Lösungen sorgen für ein intuitives digitales Erlebnis, während die skalierbare Automatisierung unserer Plattform Ihre Backoffice-Abläufe effizienter macht und Ihr Wachstum beschleunigt.

Corporate Banking

Wir bieten umfassende Lösungen für das Corporate Banking. Mit unseren Zahlungsfunktionen profitieren Geschäftskunden von sofort nutzbaren Features, während unsere Compliance-Lösungen, einschliesslich lokaler Regulierungsteams, optimal auf das Firmenkundensegment abgestimmt sind. Das gibt Ihnen die Freiheit, sich ganz auf Ihre Kundschaft zu fokussieren.

Aladdin by BlackRock

Erfahren Sie, wie die Vorintegration von Avaloq mit Aladdin Wealth™ von BlackRock Ihnen helfen kann, Ihr Anlageverwaltungsgeschäft auszubauen.

Über 170 Kunden weltweit setzen auf die Avaloq-Plattform

«Mit der Verlagerung unserer Wealth-Management-Plattform in die AWS Public Cloud ebnen wir den Weg für weiteres Wachstum in der Region. Die SaaS-Lösung von Avaloq bietet uns die nötige Flexibilität und Skalierbarkeit, um unser Leistungsversprechen einzuhalten. Indem wir unser traditionelles Private-Banking-Angebot auf die neuen digitalen Plattformen von Avaloq ausrichten, können wir das Kundenerlebnis optimieren und unsere Kundenbetreuerinnen und -betreuer dabei unterstützen, ihrer Kundschaft bei der Erreichung ihrer finanziellen Ziele zu helfen.»

Terence Chow, Head of RBC Wealth Management, Asien

Was unsere Plattform bietet

Erfahren Sie, wie wir die Bedürfnisse von Banken und Vermögensverwaltern auf einer umfassenden Front-to-Back-Plattform erfüllen.

Digitale Kanäle

Zeigen Sie Ihren Kundinnen und Kunden mit persönlich auf sie zugeschnittenen Web- und Mobile-Erlebnissen, dass Sie ihre Bedürfnisse verstehen.

Kundenverwaltung

Bieten Sie Ihrem Front Office alles, was nötig ist, um ein reibungsloses Kundenerlebnis sicherzustellen.

Investmentmanagement

Nutzen Sie leistungsstarke Portfoliomanagement- und Anlageberatungsfunktionen, um Ihr Geschäft auszubauen.

Trading

Steuern Sie alle Trading-Abläufe – vom Order-Management über das Routing und die Ausführung bis hin zur Abwicklung.

Darlehen und Kredit

Bieten Sie Ihrer Kundschaft eine breite Palette an Produkten mit umfassender Abdeckung – von der Initiierung bis zum laufenden Risikomanagement.

Zahlungen

Erreichen Sie die komplette Zahlungsabdeckung in mehreren Märkten und für alle wichtigen Protokolle und Standards.

Treasury, Risiko und Compliance

Bleiben Sie konform mit den geltenden Vorschriften und setzen Sie über Märkte und Produkte hinweg auf ein wirksames Risikomanagement.

Data Analytics

Ziehen Sie Informationen aus dem Kernbankensystem dank den neuesten Datenextraktions- und Streaming-Technologien.

Integration

Verbinden Sie sich mit Drittanbietern und profitieren Sie von der Vorab-Integration mit ausgewählten Best-of-Breed-Partnern.

Möchten Sie mehr über unsere Lösungen erfahren? Kontaktieren Sie uns noch heute, um weitere Informationen zu erhalten und zu entdecken, wie wir Ihr das Wachstum Ihres Unternehmens unterstützen können.