AML Platform

Key features

- Blockchain & API Agnostic: can be integrated with any blockchain & API

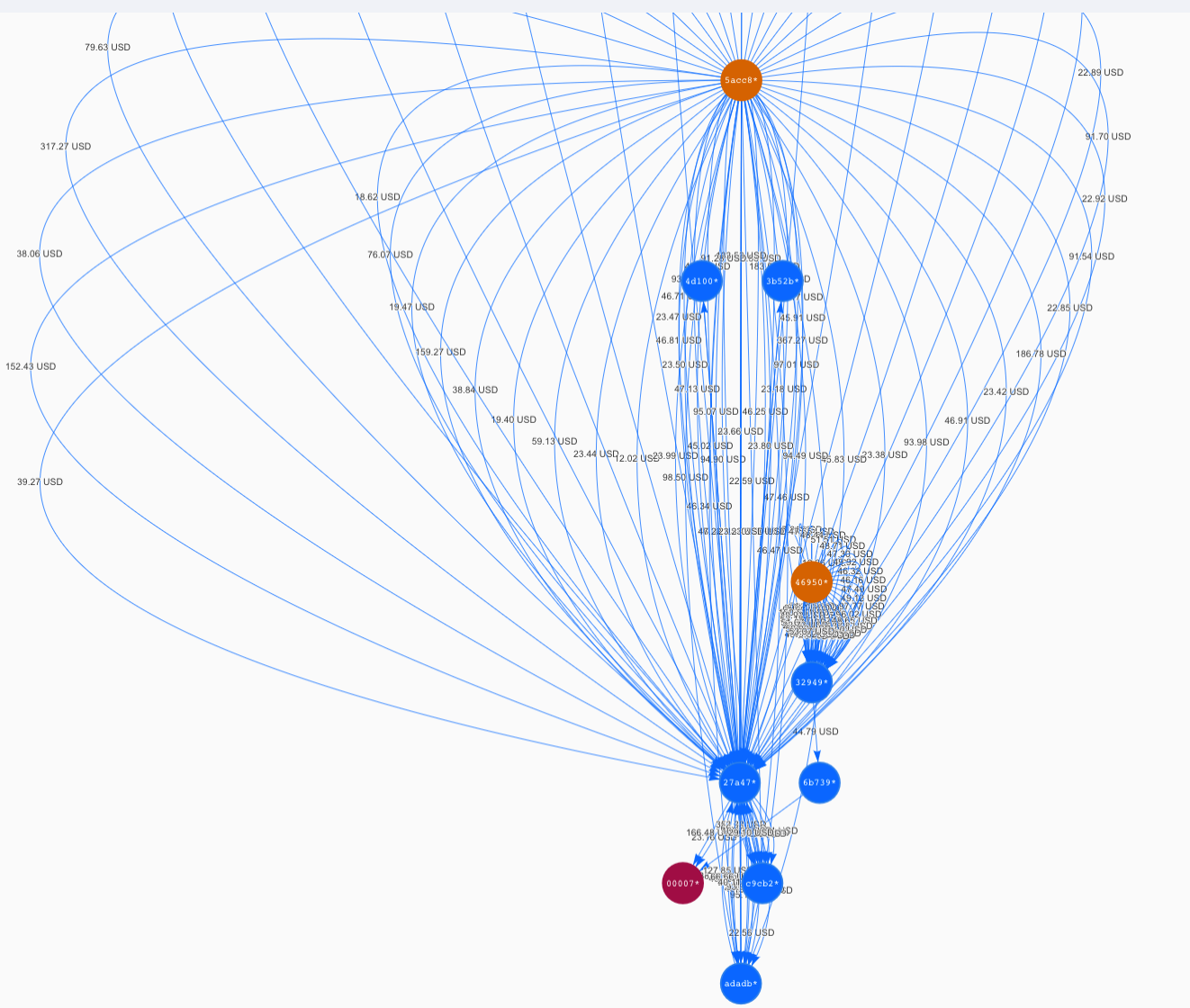

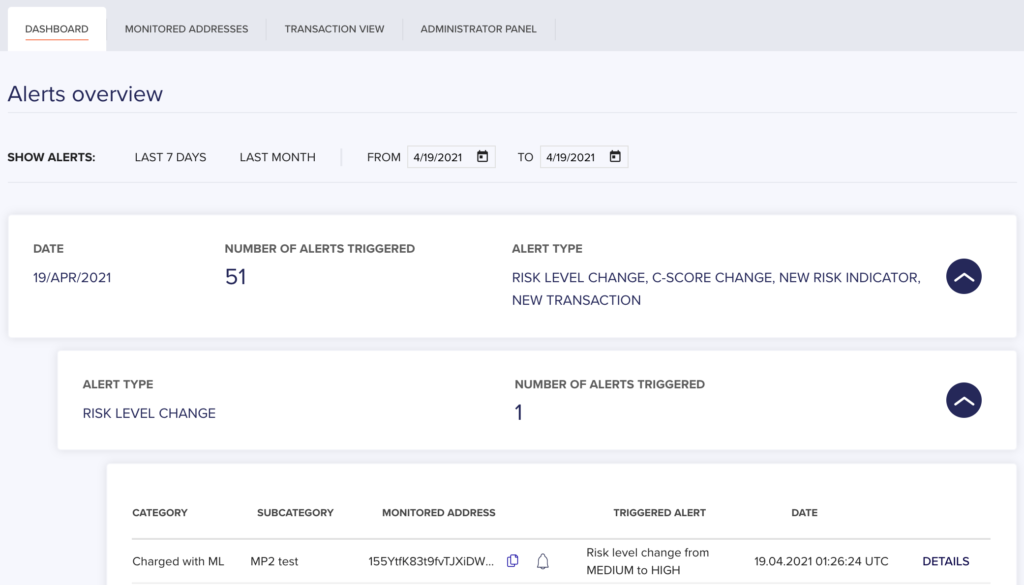

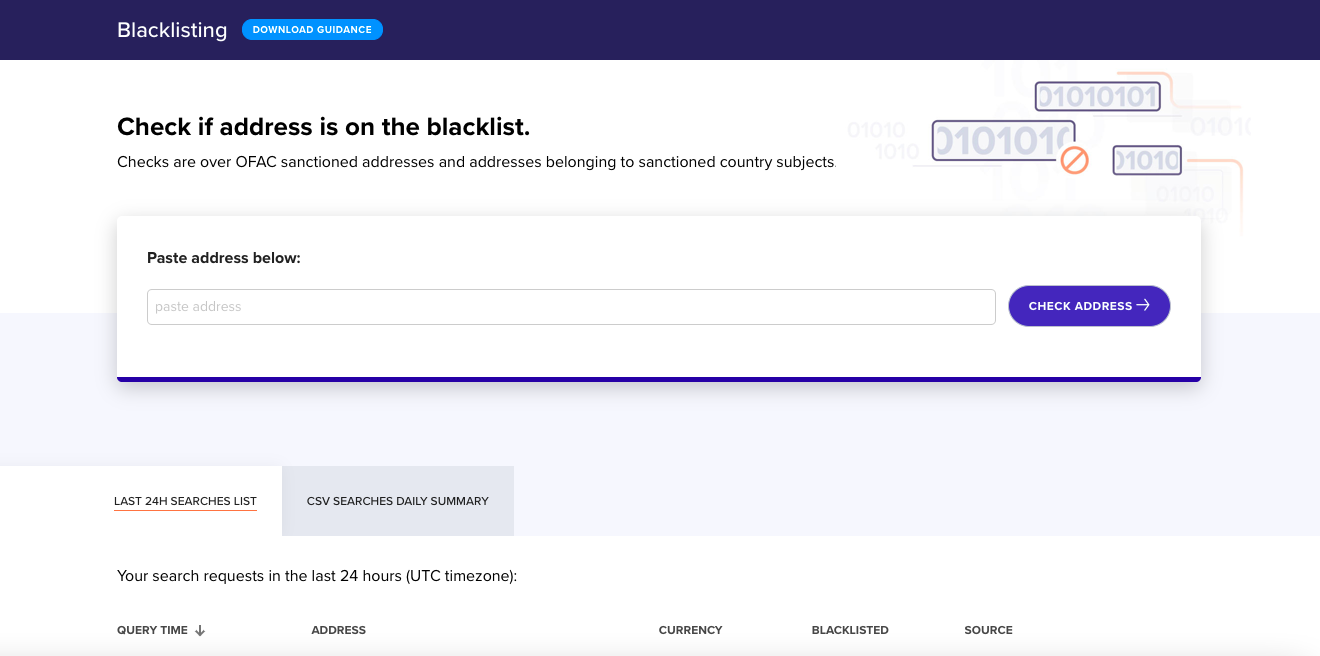

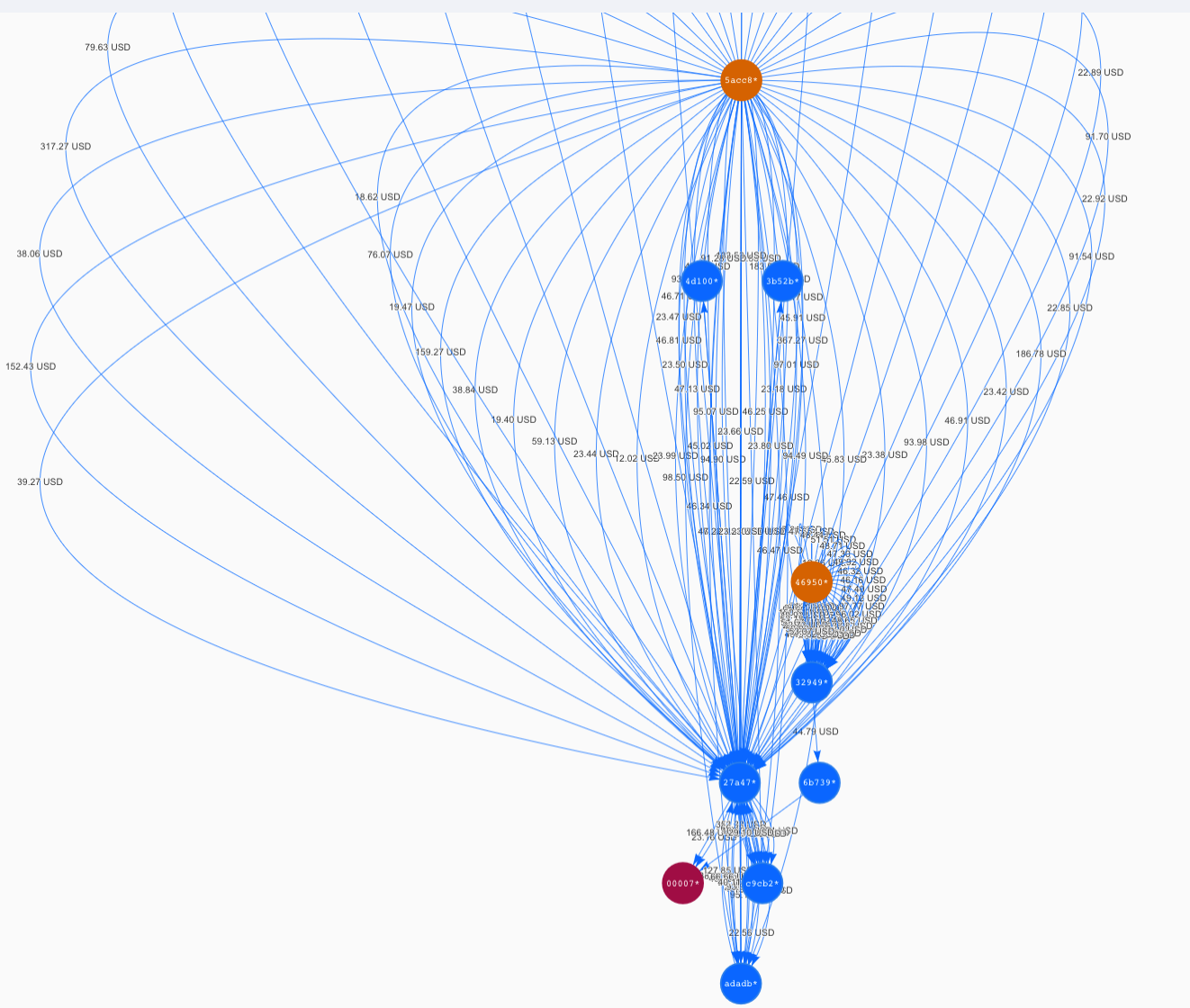

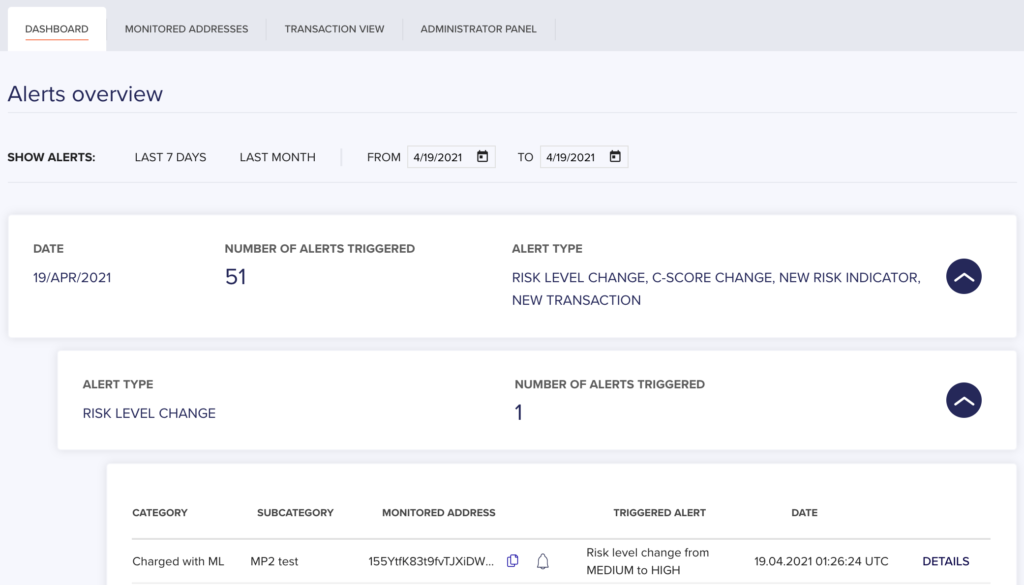

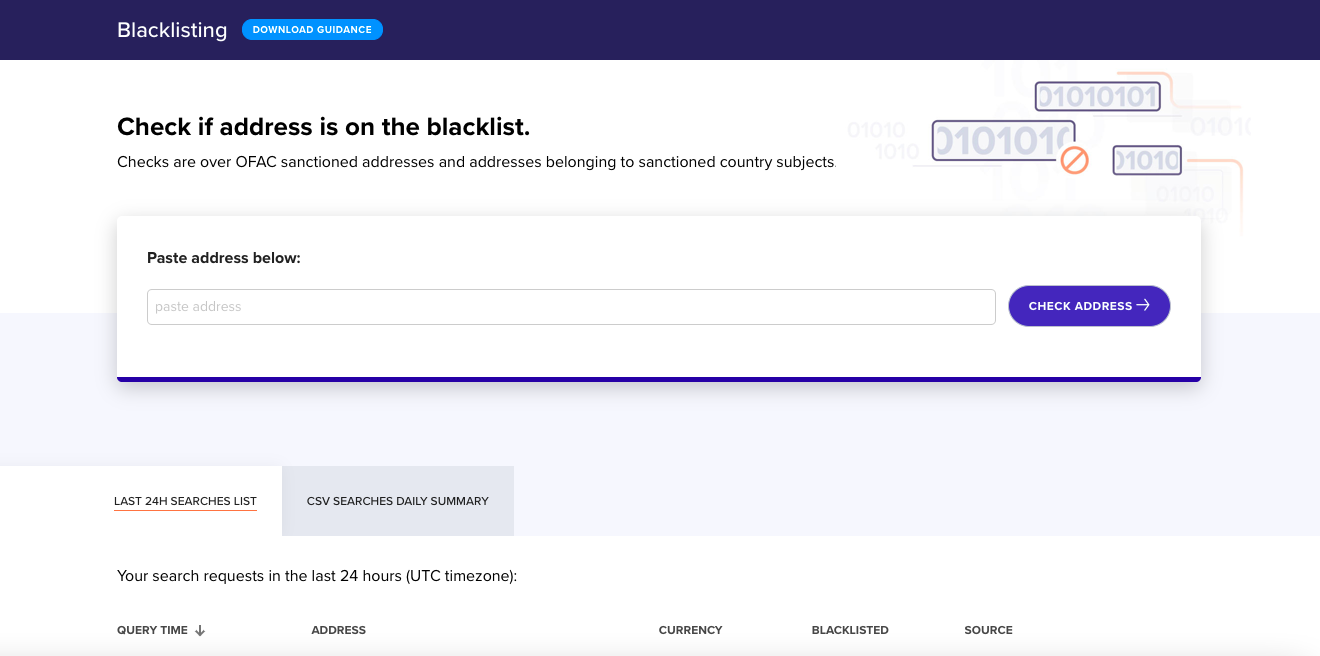

- Multi-Tool, Customizable Approach: get reports, visualize funds, investigate & trace after customizable alert thresholds

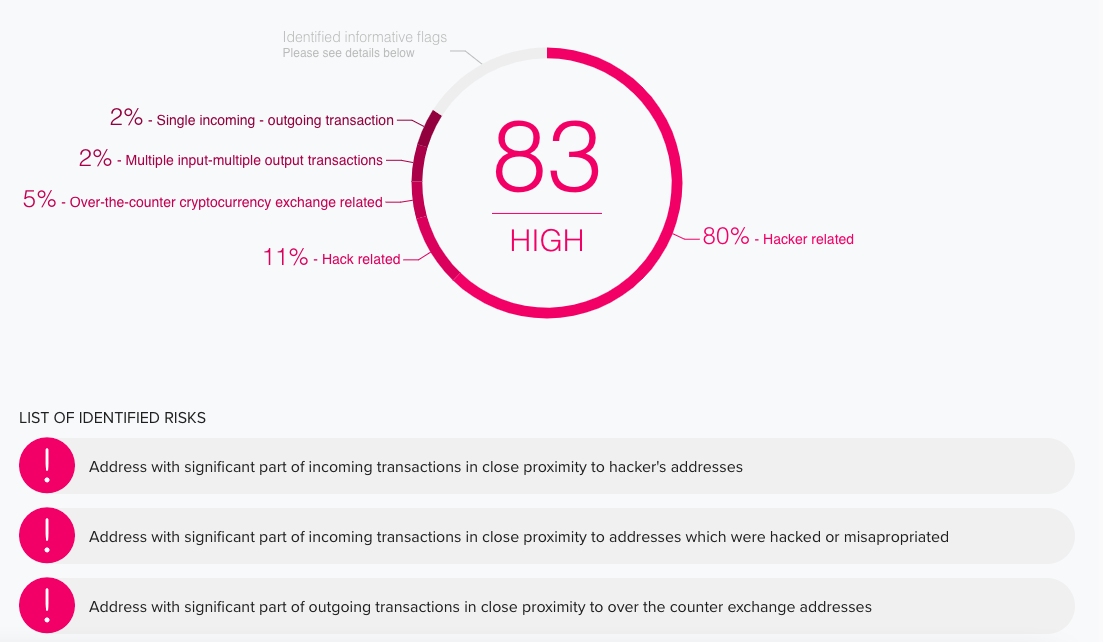

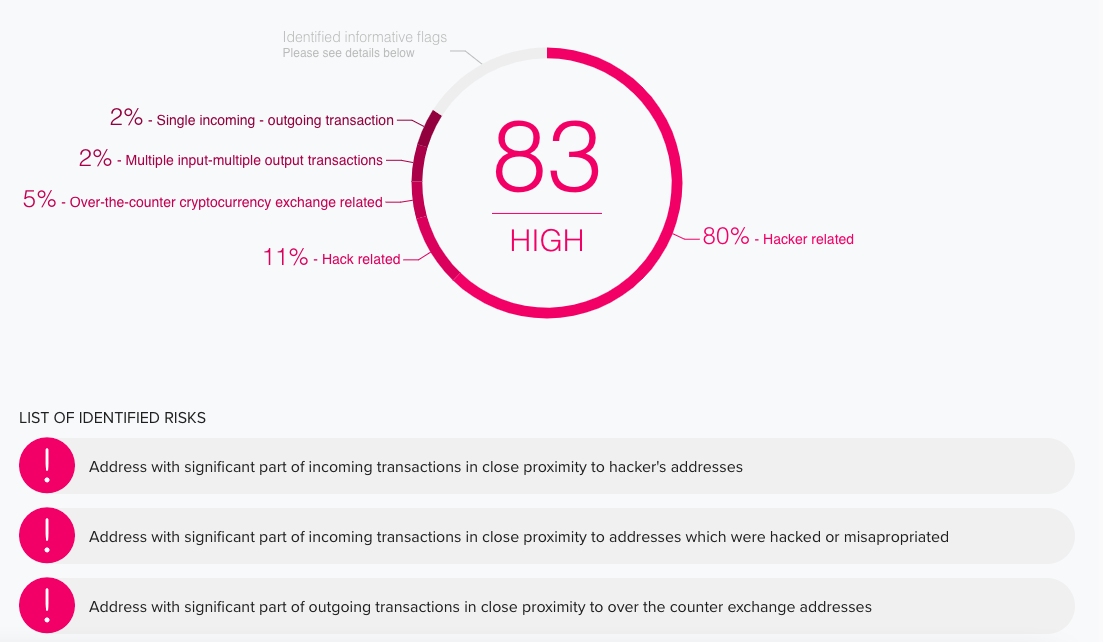

- Largest Database of Illicit Activity in Crypto: 1 petabyte of detailed & accurate sources of risk

- Streamline SAR Reporting Requirements: generating reports with enough concise information for SARs submission to FIUs

- Minimize False Positives: accurate tracing algorithms & clustering engine prevents wasted resources

Documents

Coinform AML Platform - Demo

Compliance Solutions for Cryptoasset Custody

AML risk management platform for crypto and blockchain assets

AML-Risikomanagement-Plattform für Krypto- und Blockchain-Assets

Plateforme de gestion des risques de AML pour les actifs crypto et blockchain

Plataforma de gestão de risco AML para activos criptográficos e blockchain

Key features

Key features

- Blockchain & API Agnostic: can be integrated with any blockchain & API

- Multi-Tool, Customizable Approach: get reports, visualize funds, investigate & trace after customizable alert thresholds

- Largest Database of Illicit Activity in Crypto: 1 petabyte of detailed & accurate sources of risk

- Streamline SAR Reporting Requirements: generating reports with enough concise information for SARs submission to FIUs

- Minimize False Positives: accurate tracing algorithms & clustering engine prevents wasted resources

Description

Preview

Documents

Documents

Coinform AML Platform - Demo

Compliance Solutions for Cryptoasset Custody

AML risk management platform for crypto and blockchain assets

AML-Risikomanagement-Plattform für Krypto- und Blockchain-Assets

Plateforme de gestion des risques de AML pour les actifs crypto et blockchain

Plataforma de gestão de risco AML para activos criptográficos e blockchain