Realistic Goal-based Investing with Professional ALM Methods

We offer intelligent algorithms as SaaS/APIs that cover full advisory processes or complement existing advisory processes. Our goal-based investing solutions are most realistic and allow for multi-goal optimisation, holistic wealth management and the simulation of climate change scenarios.

Key features

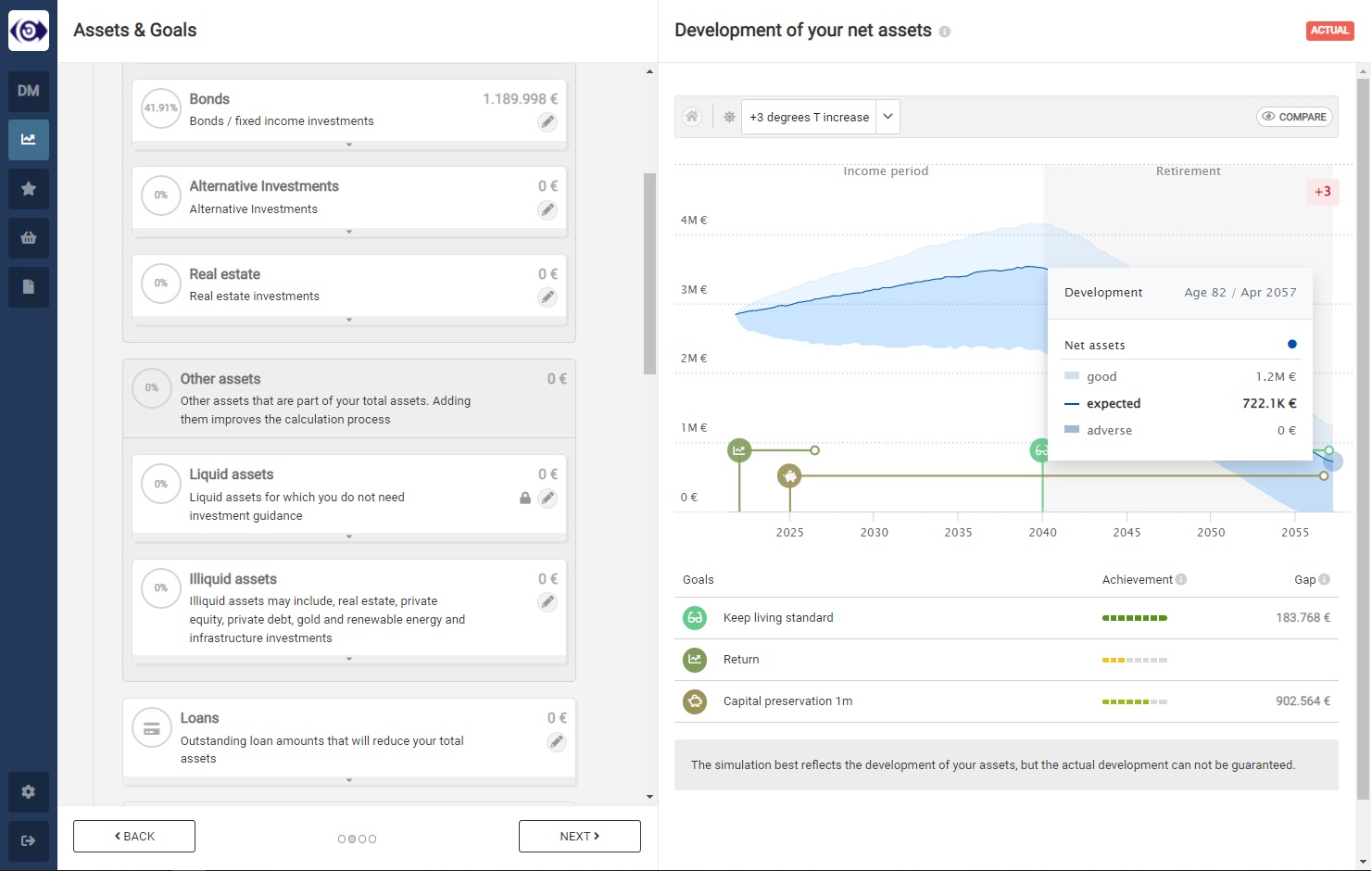

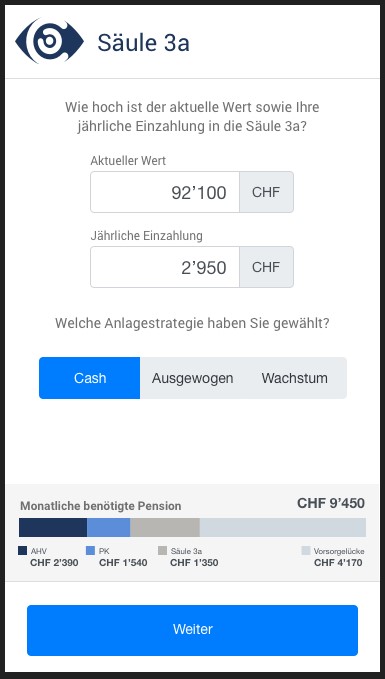

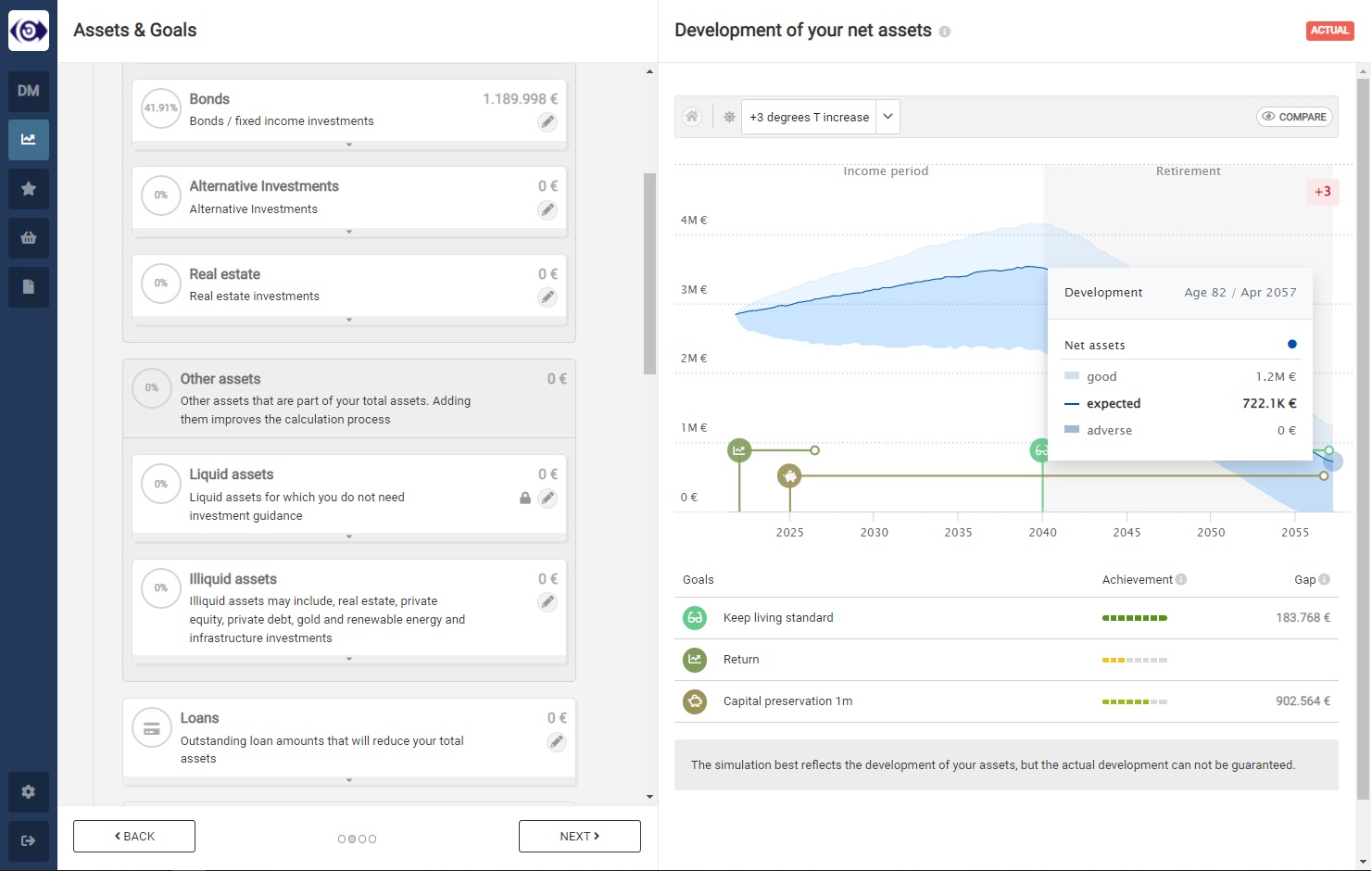

- Scenario-based, realistic goal-based investing that includes climate scenarios and non-normal distribution

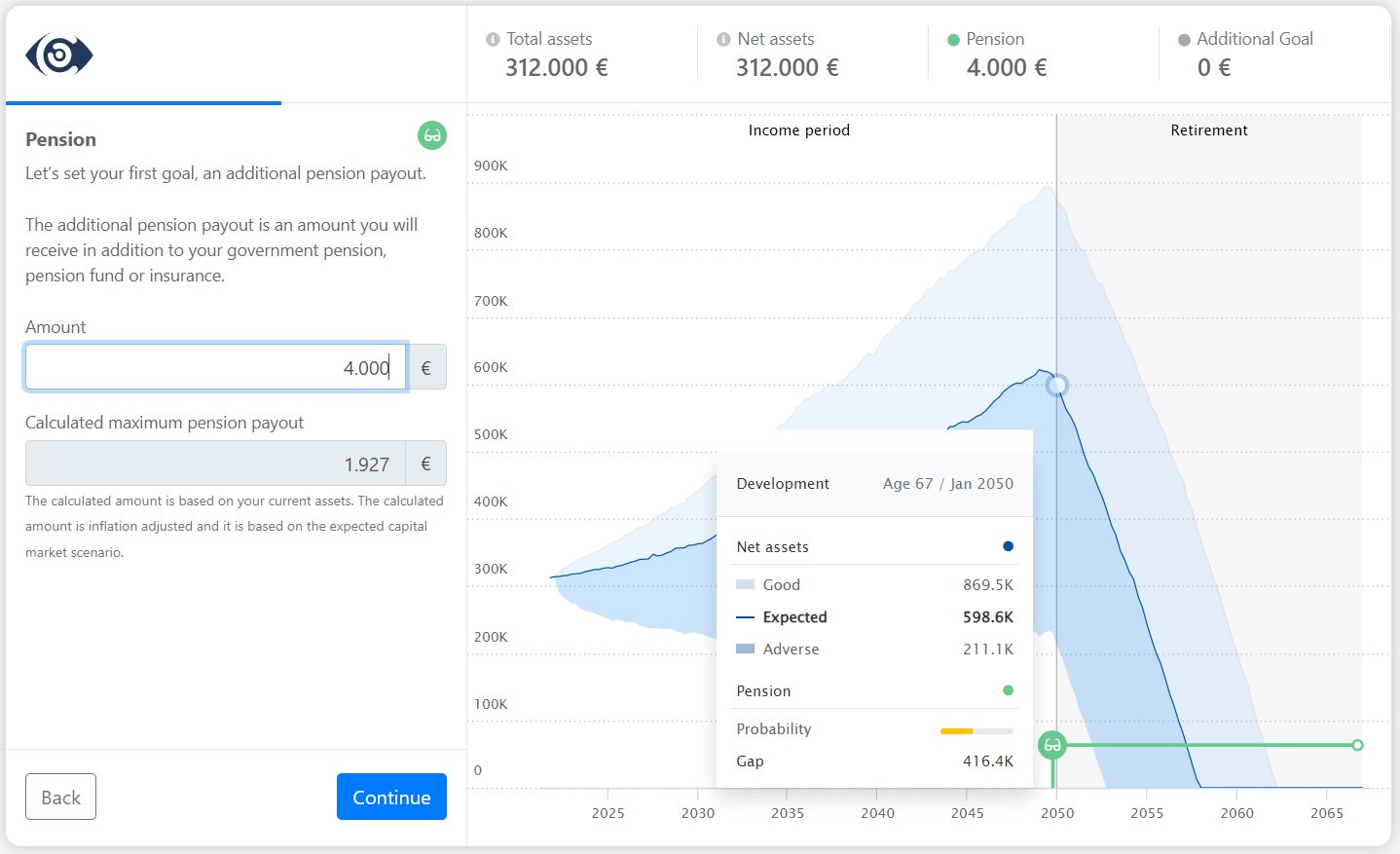

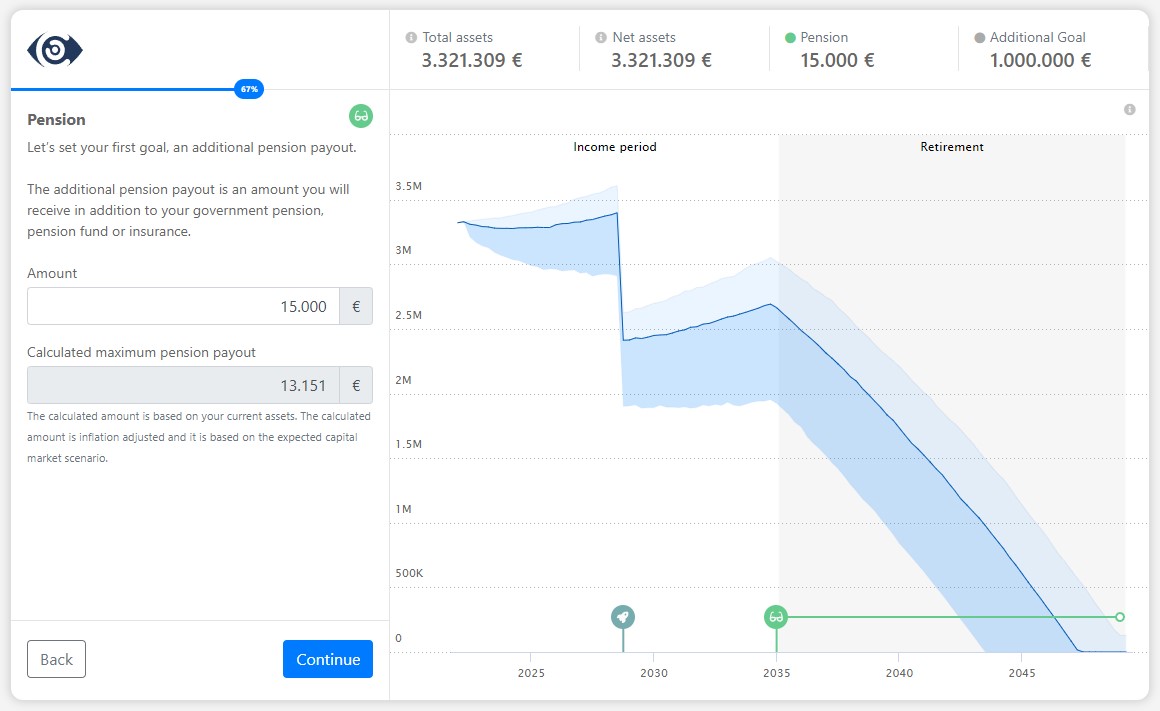

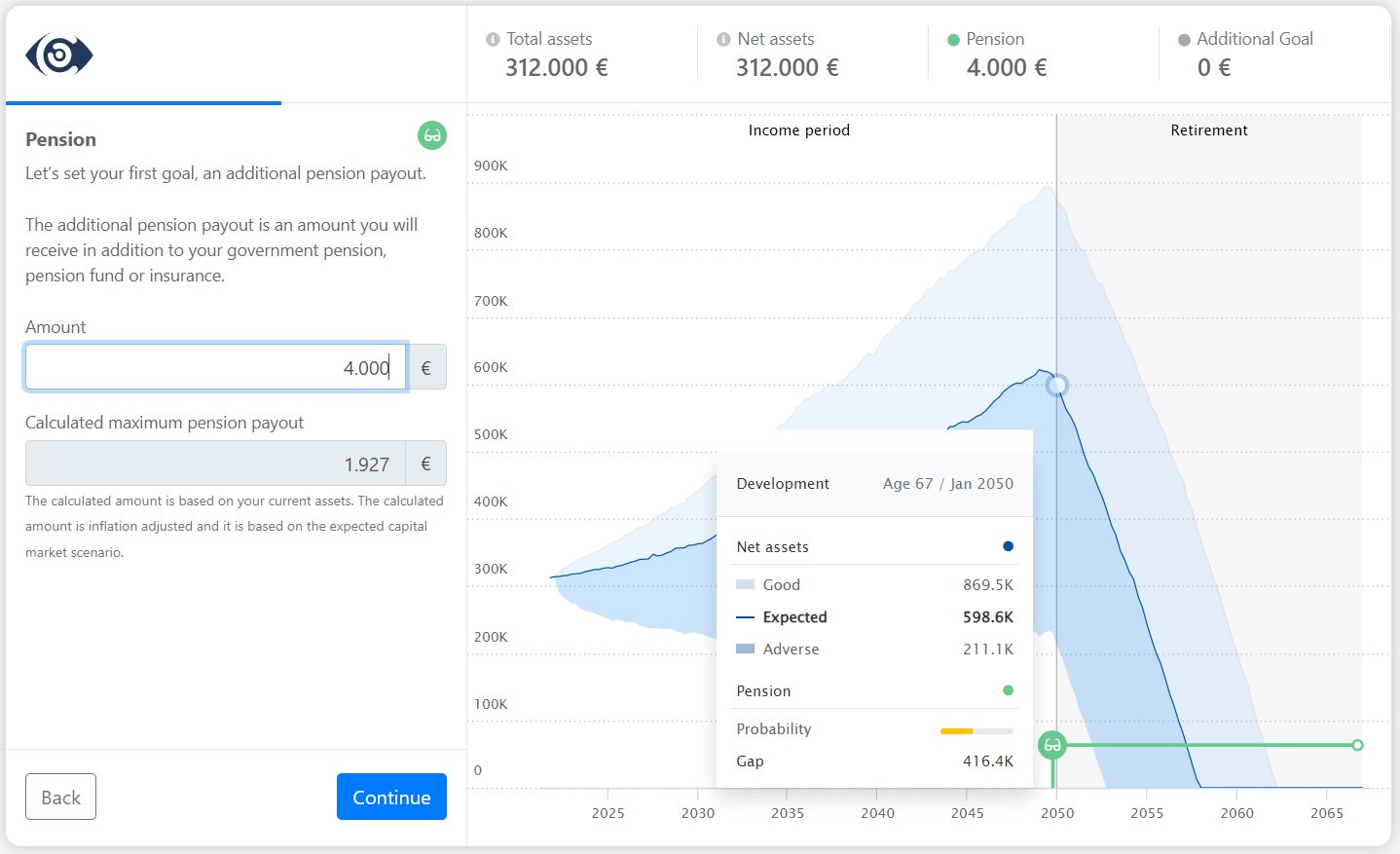

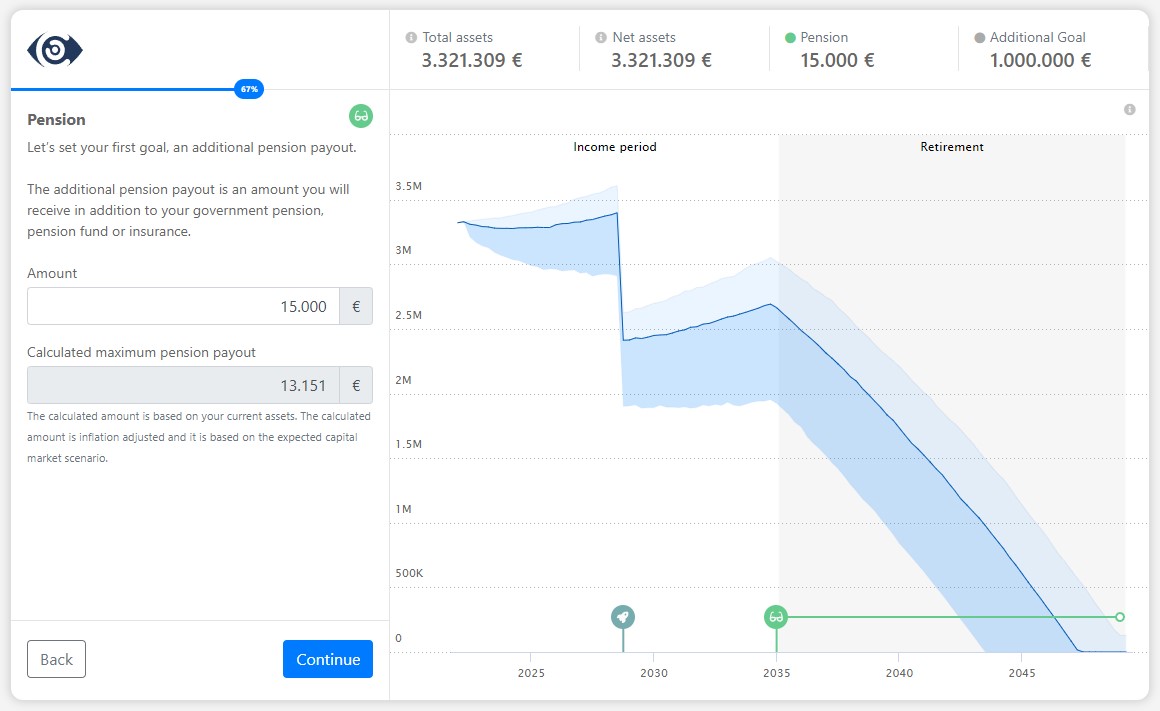

- Instant goal probability calculation for multiple financial goals

- Multi-goal optimisation with flexibility to select the preferred optimisation function

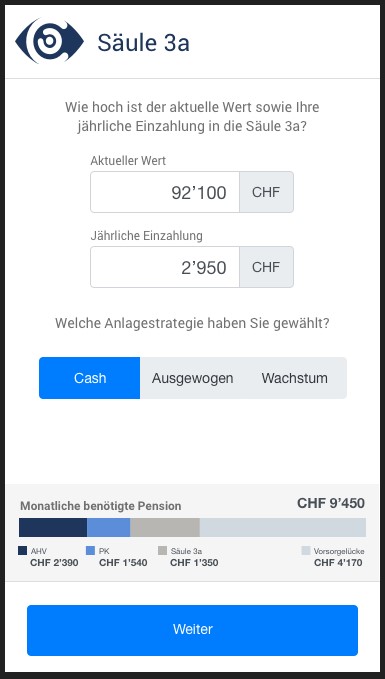

- Holistic Wealth Management including illiquid assets and credits

- Hyper-personalisation of the strategic asset allocation that includes the CIO view

Key features

Key features

- Scenario-based, realistic goal-based investing that includes climate scenarios and non-normal distribution

- Instant goal probability calculation for multiple financial goals

- Multi-goal optimisation with flexibility to select the preferred optimisation function

- Holistic Wealth Management including illiquid assets and credits

- Hyper-personalisation of the strategic asset allocation that includes the CIO view

Description

Preview