Storage & Tokenisation Solution - Secure digital asset storage and management

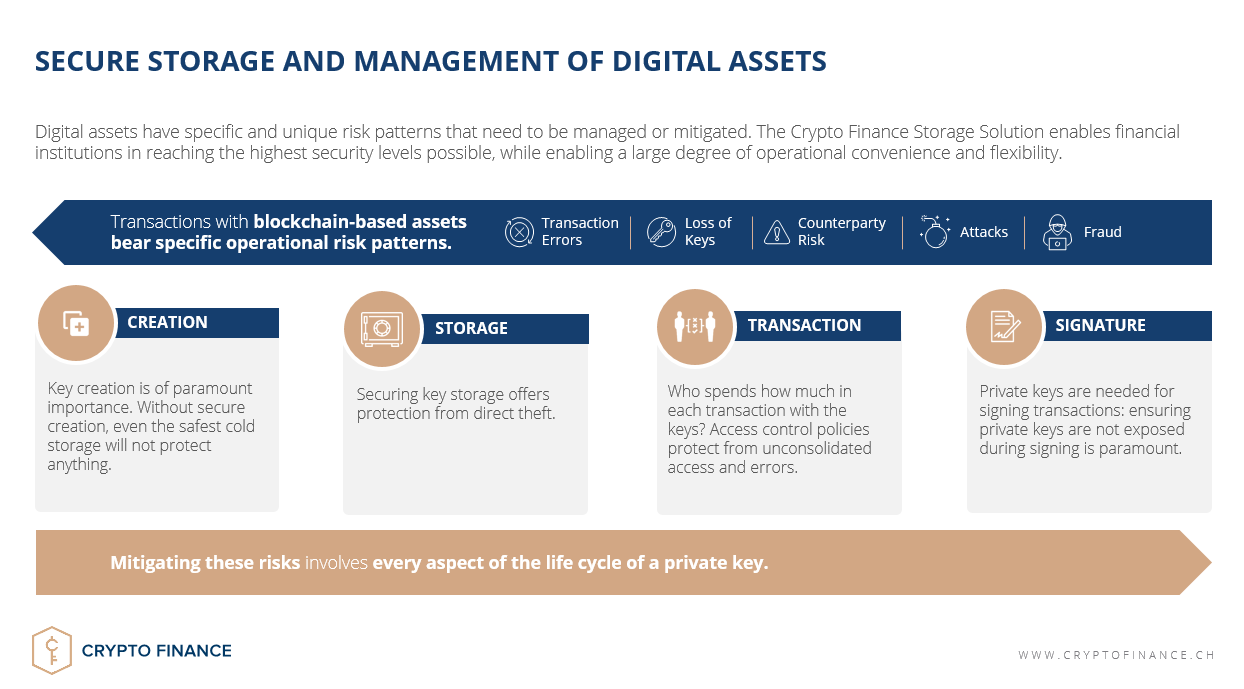

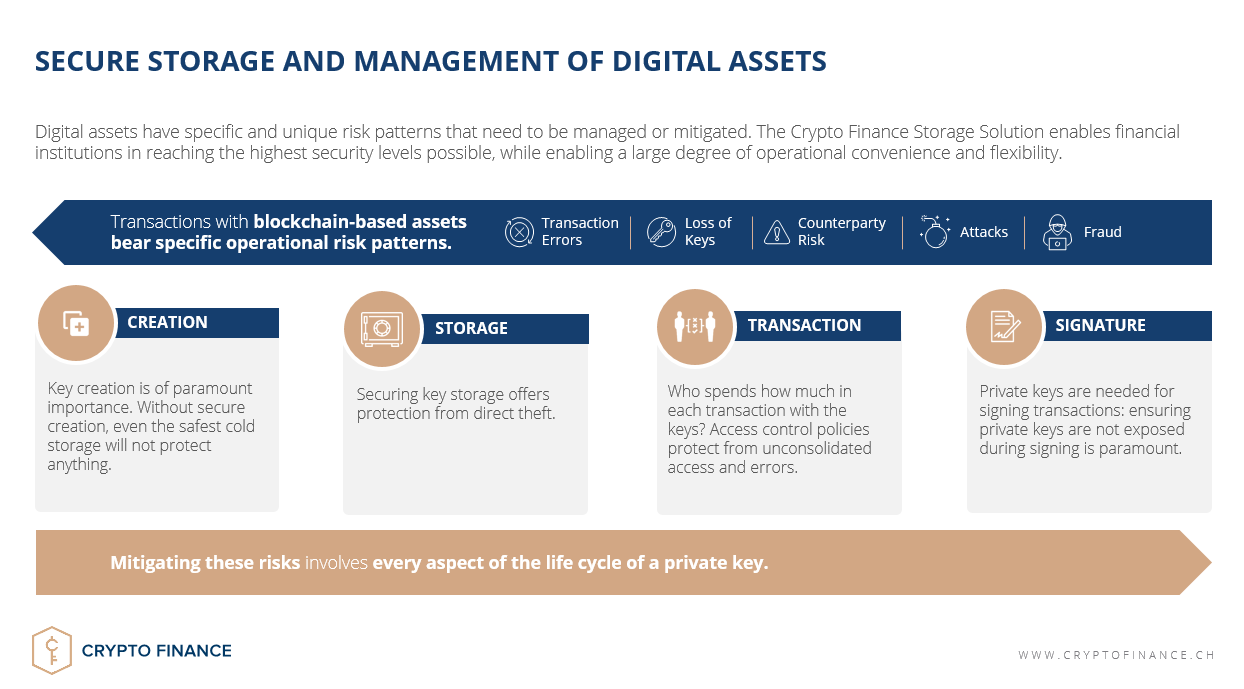

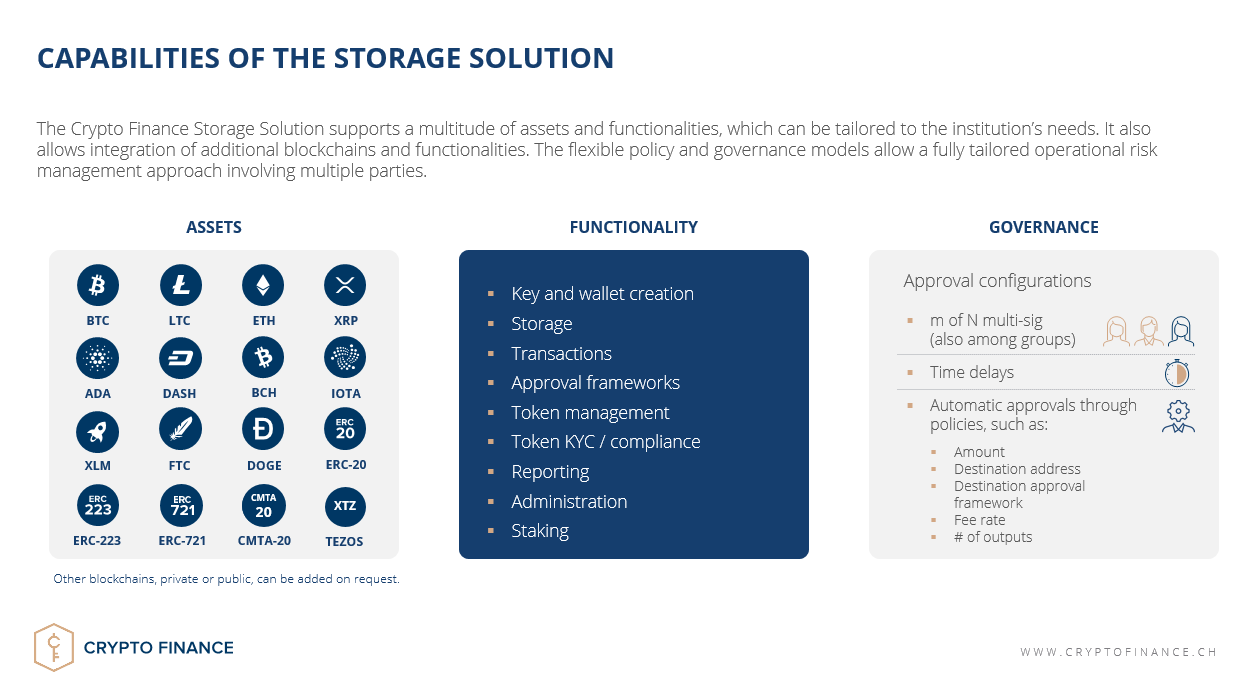

The Crypto Finance Storage Solution enables financial institutions to securely store and manage digital assets for themselves and their clients.

Key features

- Secure key creation and management based on certified tamper-proof hardware.

- Flexible wallet management for a seamless integration into target operating models.

- Secure policy management and governance functionalities for the defined operational processes.

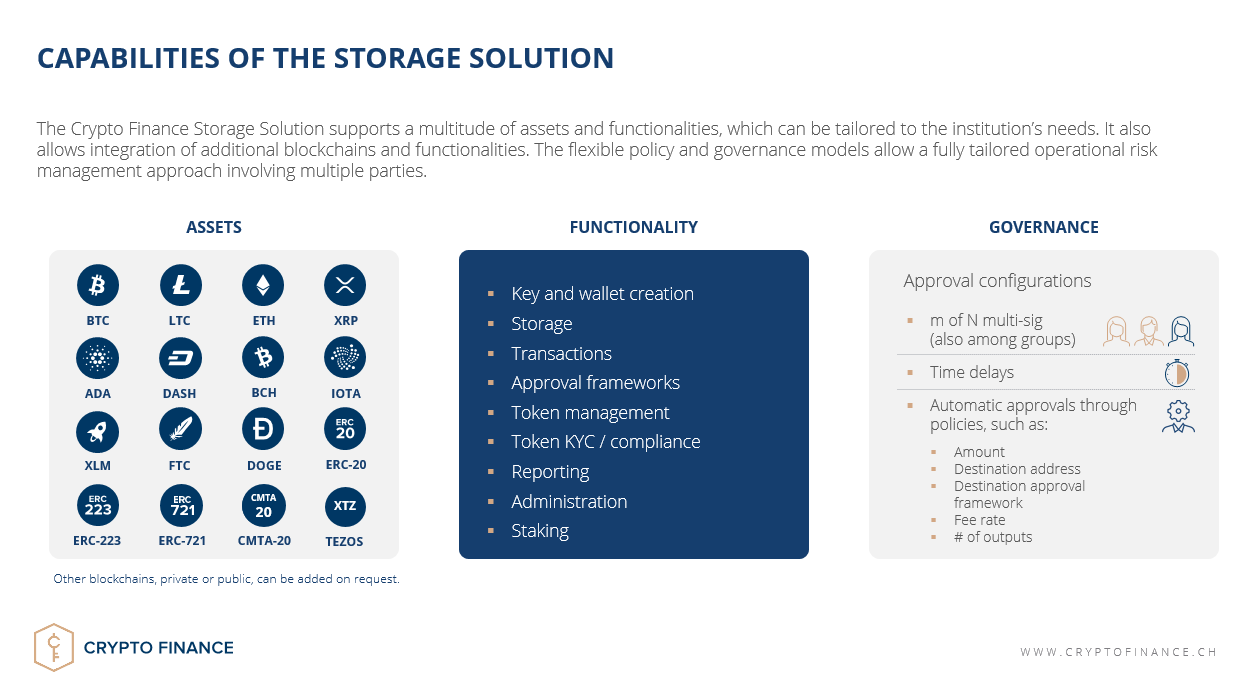

- Various digital assets and standards supported, such as BTC, ETH, Ripple, IOTA, Cardano, ERC20, CMTA20, and many more.

- Flexible off-chain access control of any smart contract function call.

Key features

Key features

- Secure key creation and management based on certified tamper-proof hardware.

- Flexible wallet management for a seamless integration into target operating models.

- Secure policy management and governance functionalities for the defined operational processes.

- Various digital assets and standards supported, such as BTC, ETH, Ripple, IOTA, Cardano, ERC20, CMTA20, and many more.

- Flexible off-chain access control of any smart contract function call.

Description

Preview