ABAKA Content & Analytics

Not every customer you have will engage with you in the same way. That’s why we provide ongoing customer engagement through personalised content and smart analytics, allowing you to tailor your approach.

Key features

- Digital content & marketing platform with pre-built library of tagged content

- Integrate your own content with your desired “tone of voice” and/or integration third parties’ content

- Delivery via ABAKA’s intelligent nudging modules or mail, video, chat, SMS or other notifications

- Full suite of analytics to measure customer activation & penetration across demographics, including A/B testing

- Fully customisable dashboards and data queries available as part of a complete reporting suite

Key features

Key features

- Digital content & marketing platform with pre-built library of tagged content

- Integrate your own content with your desired “tone of voice” and/or integration third parties’ content

- Delivery via ABAKA’s intelligent nudging modules or mail, video, chat, SMS or other notifications

- Full suite of analytics to measure customer activation & penetration across demographics, including A/B testing

- Fully customisable dashboards and data queries available as part of a complete reporting suite

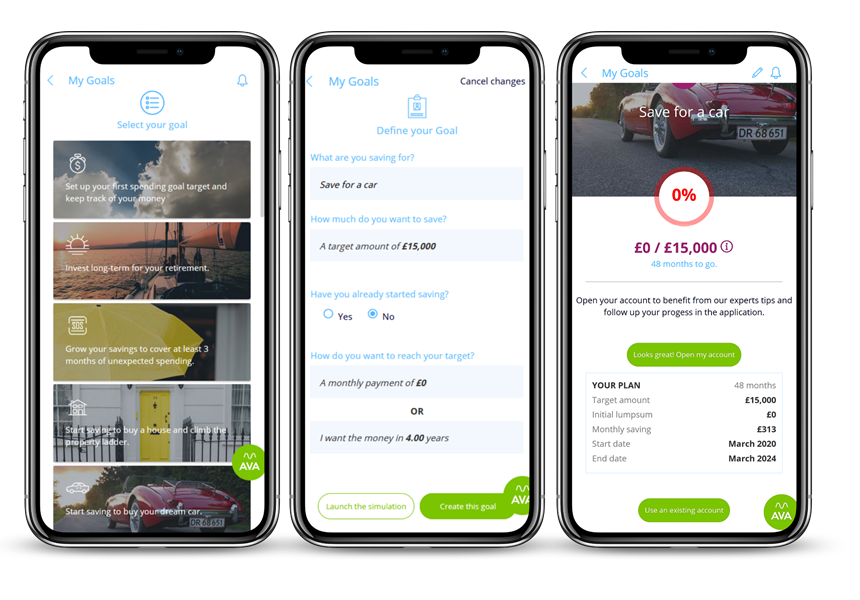

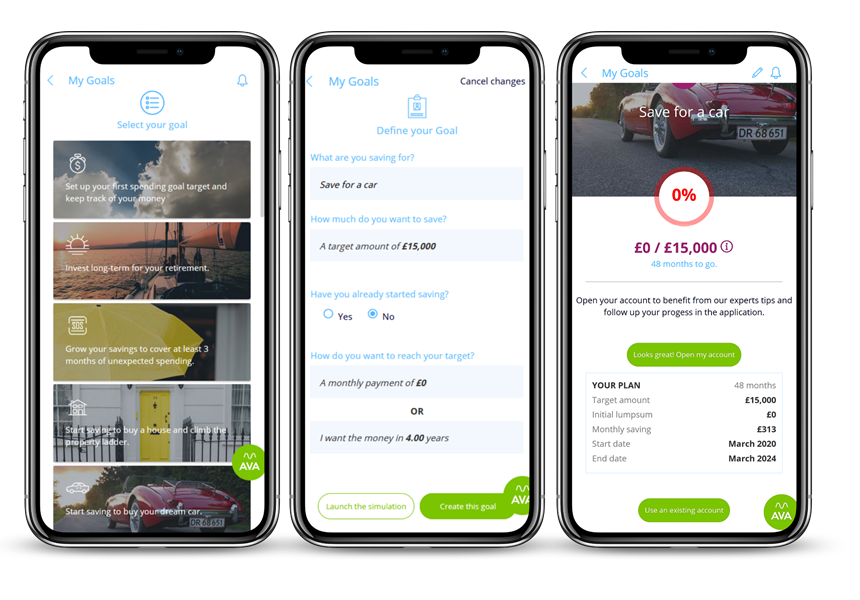

Description

Preview