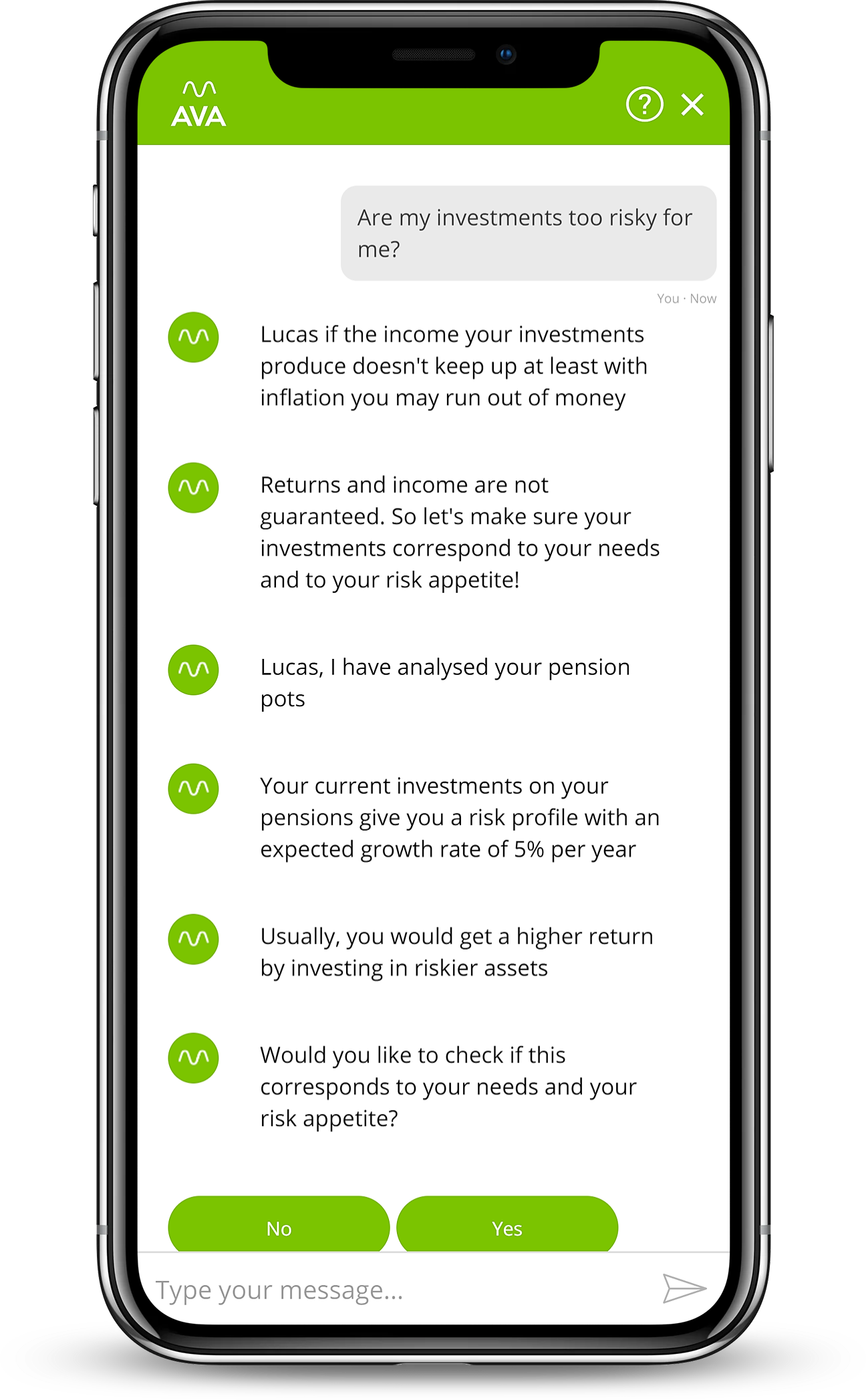

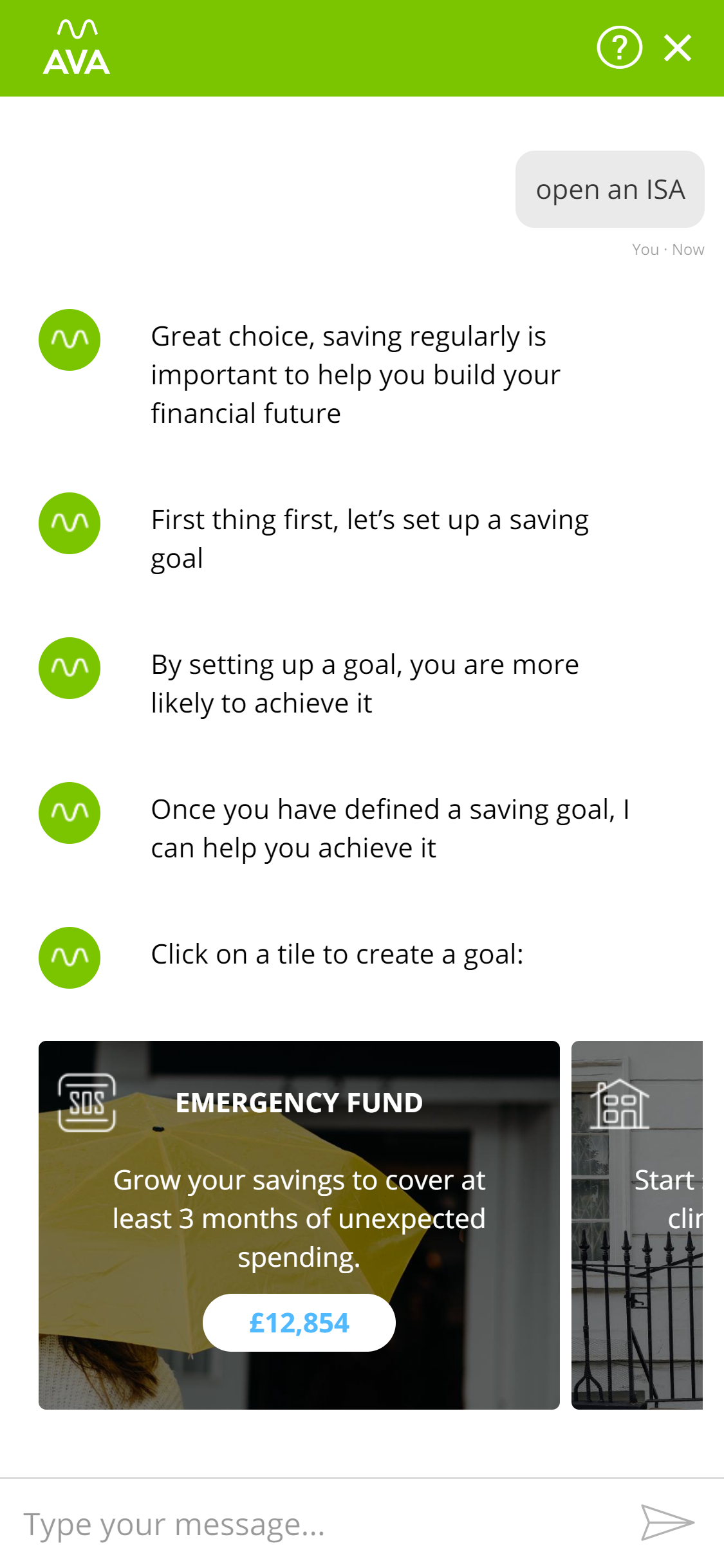

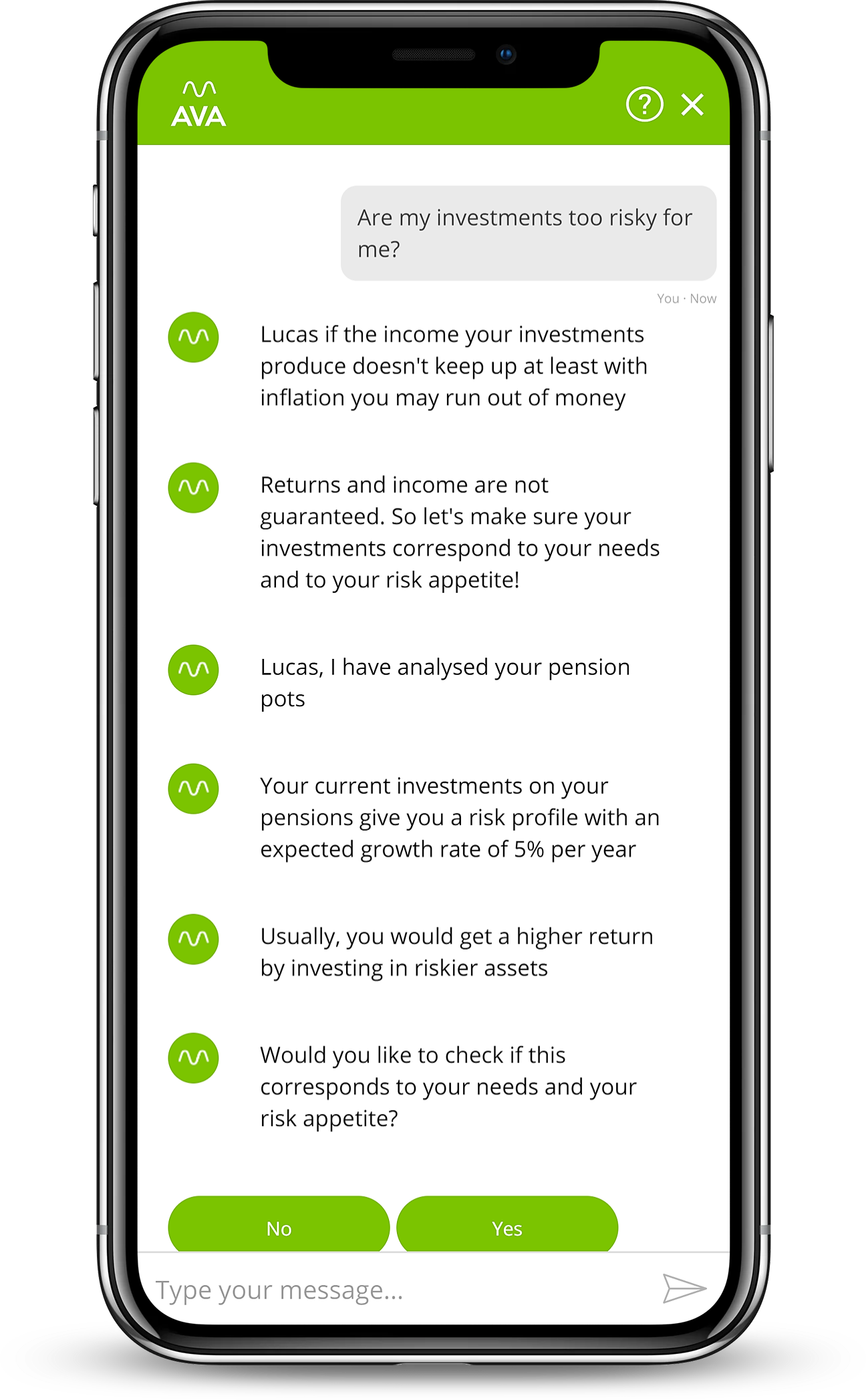

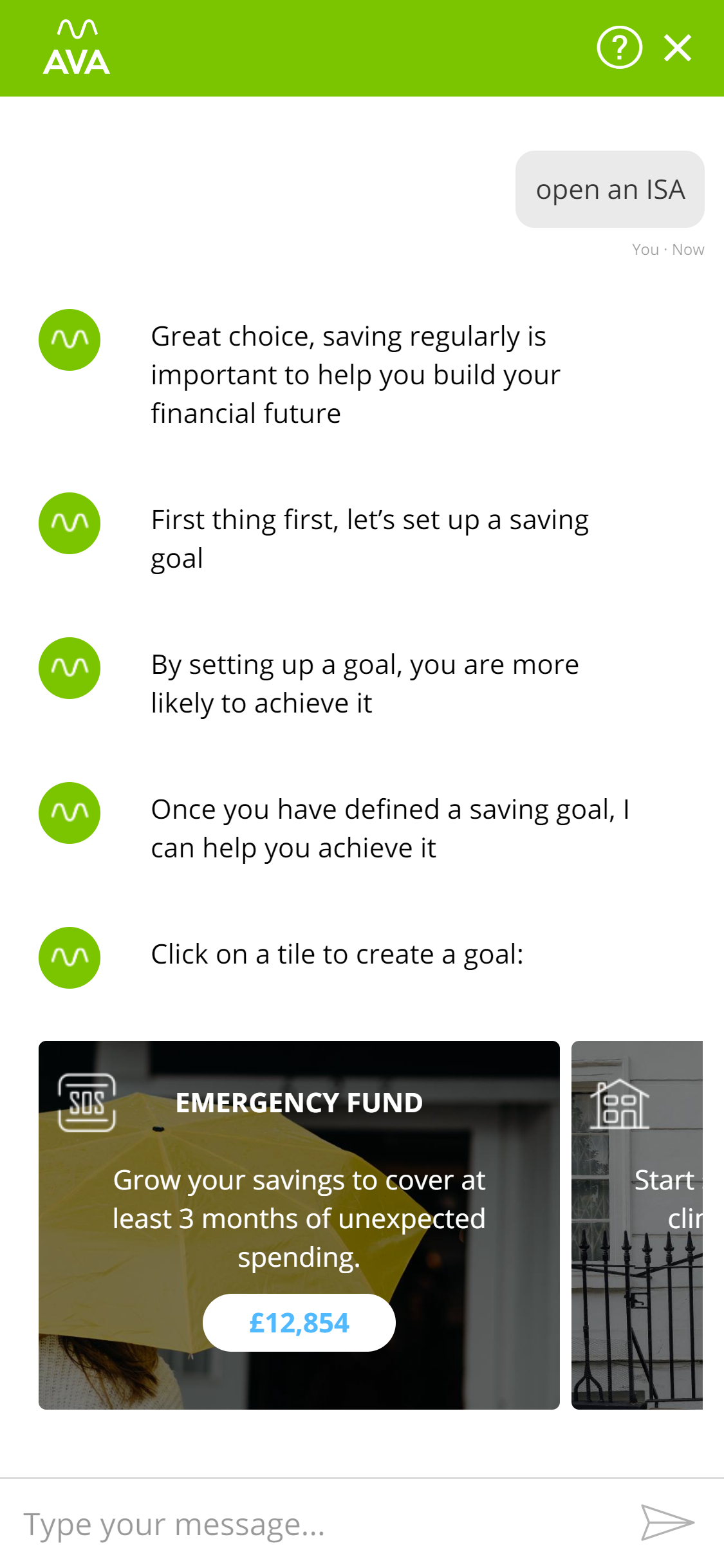

ABAKA Conversational AI & Chatbot

Enterprise level conversational artificial intelligence/natural language processing with deep domain-specific knowledge on retirement, savings & investments.

Key features

- Natural Language Processing: proprietary technology powering human-like conversations with customers

- Domain specific knowledge: deep DSK on retirement, savings and investments

- Transactional capabilities built in (e.g. open a savings a/c, manage contributions, transfer a/c, link external a/c)

- Omnichannel: Reach your clients where they are including WhatsApp, Facebook Messenger, SIRI, Alexa, Cortana, etc

- Journey Design: our web Canvas technology allows full customisation of customer journeys with no hard cording required

Key features

Key features

- Natural Language Processing: proprietary technology powering human-like conversations with customers

- Domain specific knowledge: deep DSK on retirement, savings and investments

- Transactional capabilities built in (e.g. open a savings a/c, manage contributions, transfer a/c, link external a/c)

- Omnichannel: Reach your clients where they are including WhatsApp, Facebook Messenger, SIRI, Alexa, Cortana, etc

- Journey Design: our web Canvas technology allows full customisation of customer journeys with no hard cording required

Description

Preview