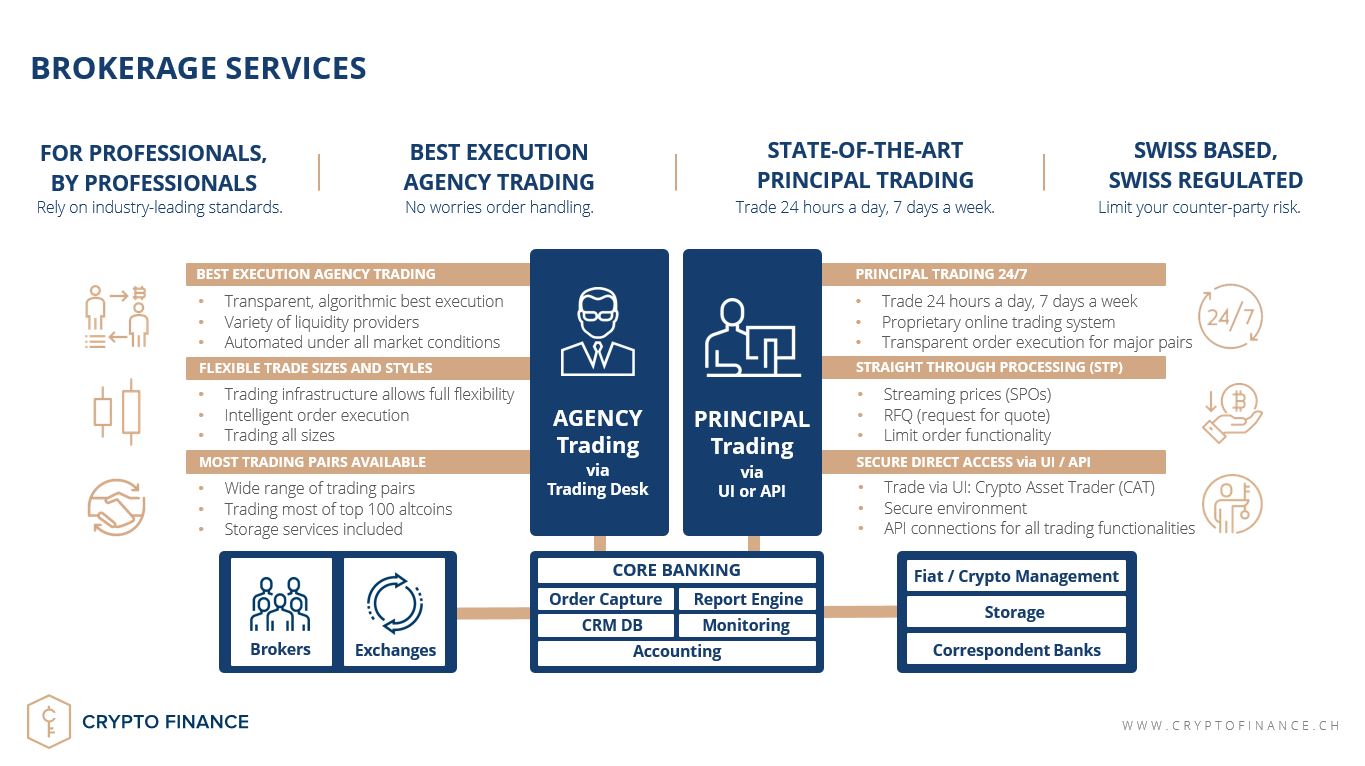

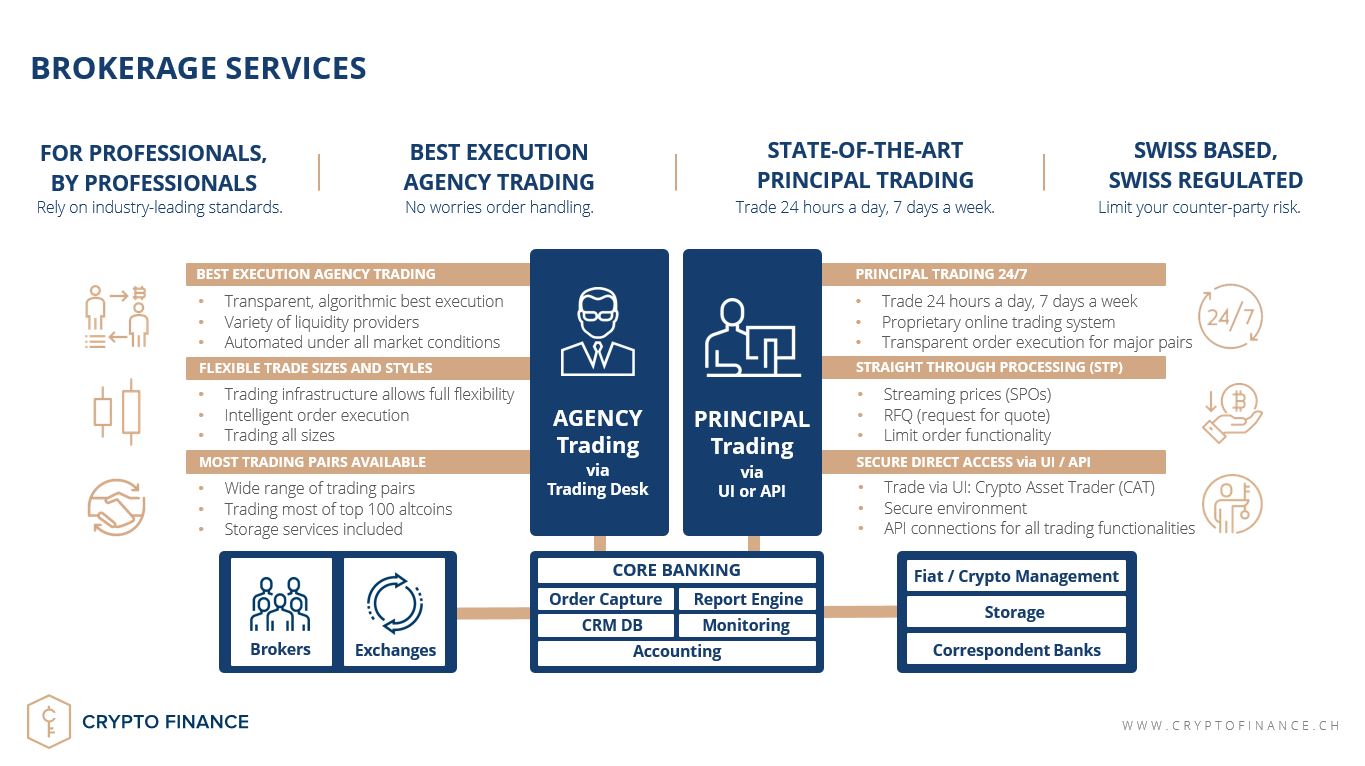

Crypto Brokerage Services - FINMA-regulated access to digital assets markets

The Crypto Finance brokerage allows banks and other financial institutions to participate in the emerging digital asset class with secure, liquid, and transparent order execution. The group brokerage is a FINMA-licenced securities firm, and all clients benefit from 24/7 liquidity provision.

Key features

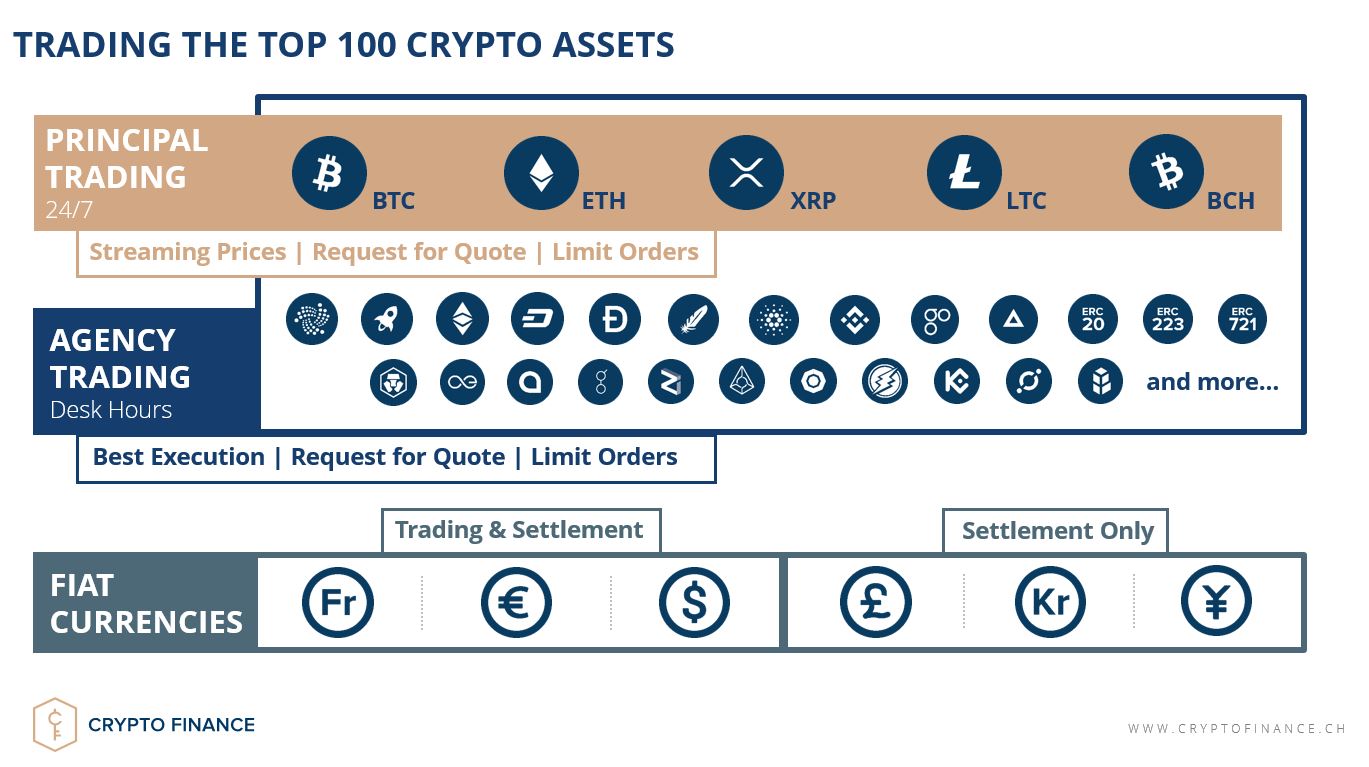

- Fully automated principal trading 24/7 - BTC, ETH, LTC, BCH, XRP versus CHF, EUR, USD.

- Best execution agency trading - most trading pairs available.

- Post-trade settlement limits - ensuring availability for all clients.

- Flexible trade sizes and styles - market orders, limit, orders, requests for quote, stop order, and stop limit orders.

Key features

Key features

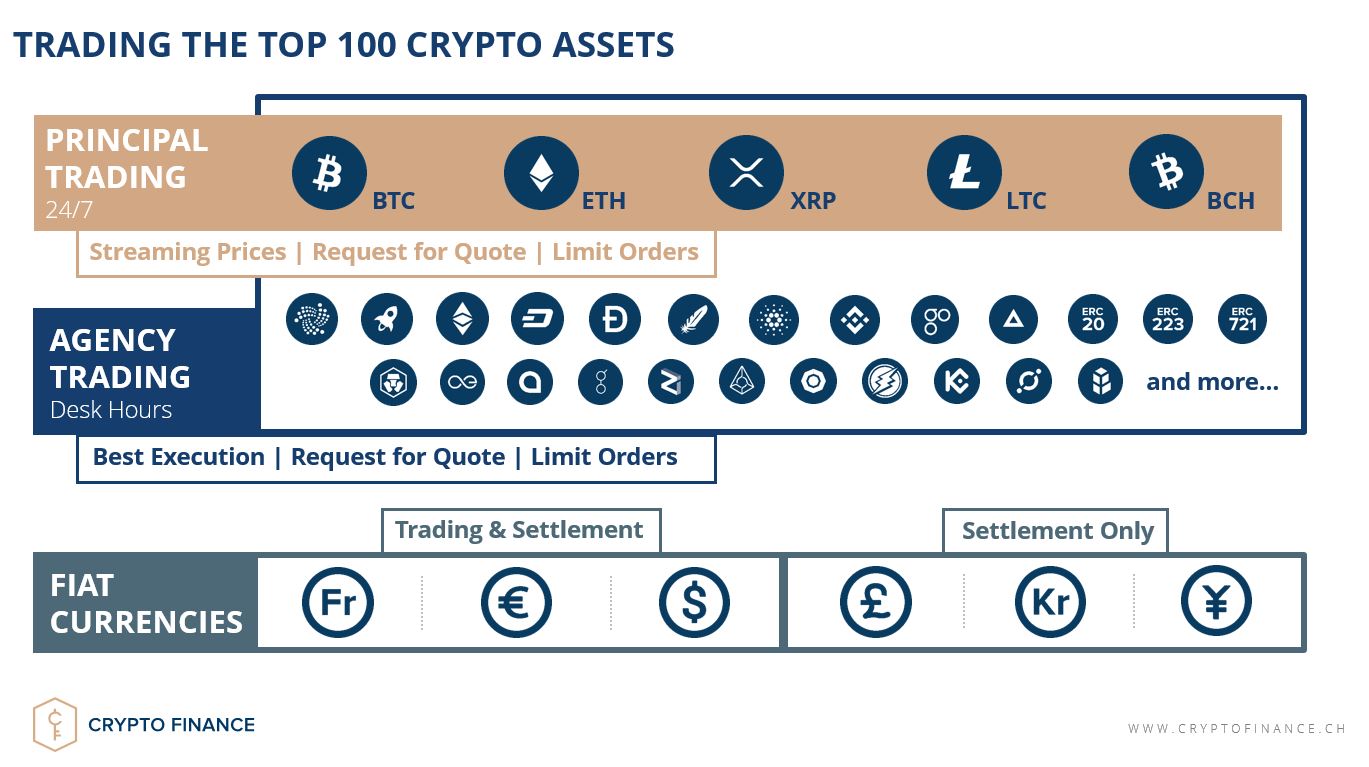

- Fully automated principal trading 24/7 - BTC, ETH, LTC, BCH, XRP versus CHF, EUR, USD.

- Best execution agency trading - most trading pairs available.

- Post-trade settlement limits - ensuring availability for all clients.

- Flexible trade sizes and styles - market orders, limit, orders, requests for quote, stop order, and stop limit orders.

Description

Preview