Crypto Custody Services - Secure FINMA-regulated digital asset custody

Crypto Finance provides digital asset custody and investment for banks and other financial institutions and participation in the emerging digital asset class with secure, 24/7, liquid, transparent order execution. The group is licenced by FINMA as a securities firm.

Key features

- Secure storage for your clients' digital assets with a tamper-proof hardware solution.

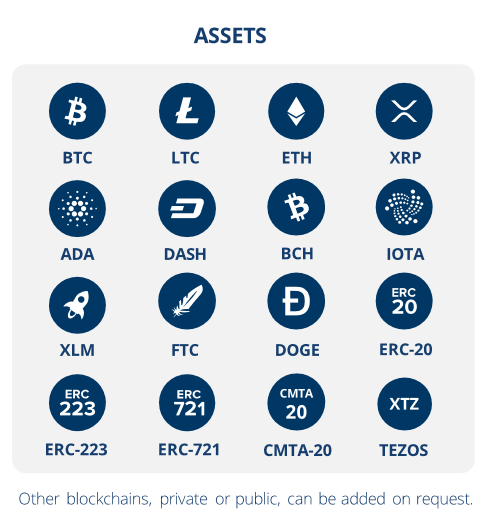

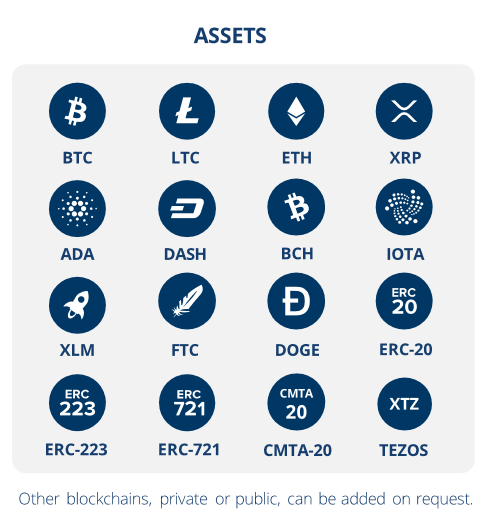

- Various digital assets and standards supported, such as BTC, ETH, Ripple, IOTA, Cardano, ERC20, CMTA20, and many more.

- FINMA-regulated services and processes with our licenced FINMA securities firm.

- Regular audits by Ernst & Young and a SOC2/ISAE 3000 report is available.

Key features

Key features

- Secure storage for your clients' digital assets with a tamper-proof hardware solution.

- Various digital assets and standards supported, such as BTC, ETH, Ripple, IOTA, Cardano, ERC20, CMTA20, and many more.

- FINMA-regulated services and processes with our licenced FINMA securities firm.

- Regular audits by Ernst & Young and a SOC2/ISAE 3000 report is available.

Description

Preview