strukis.com

Key features

- Generate trading ideas for structured products

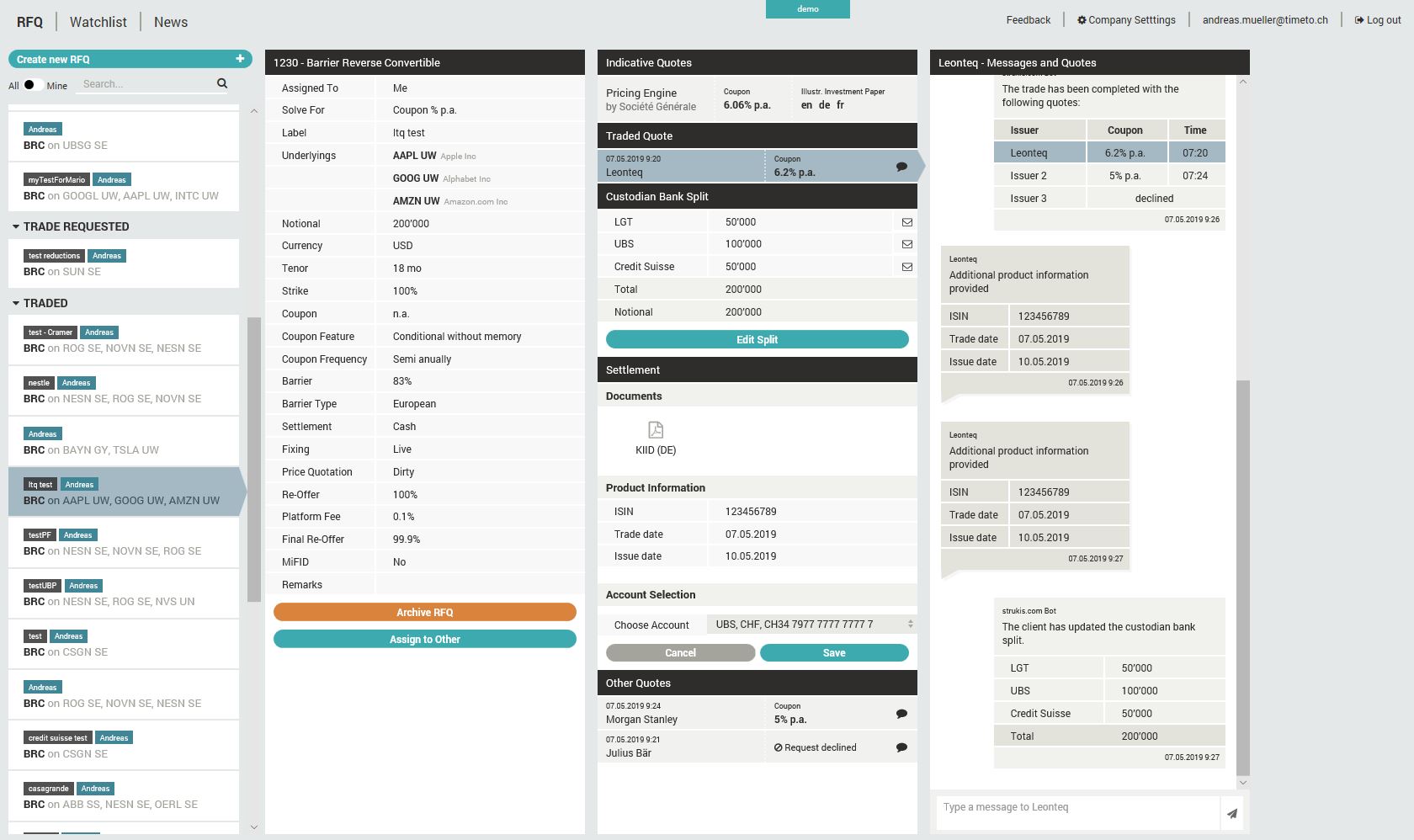

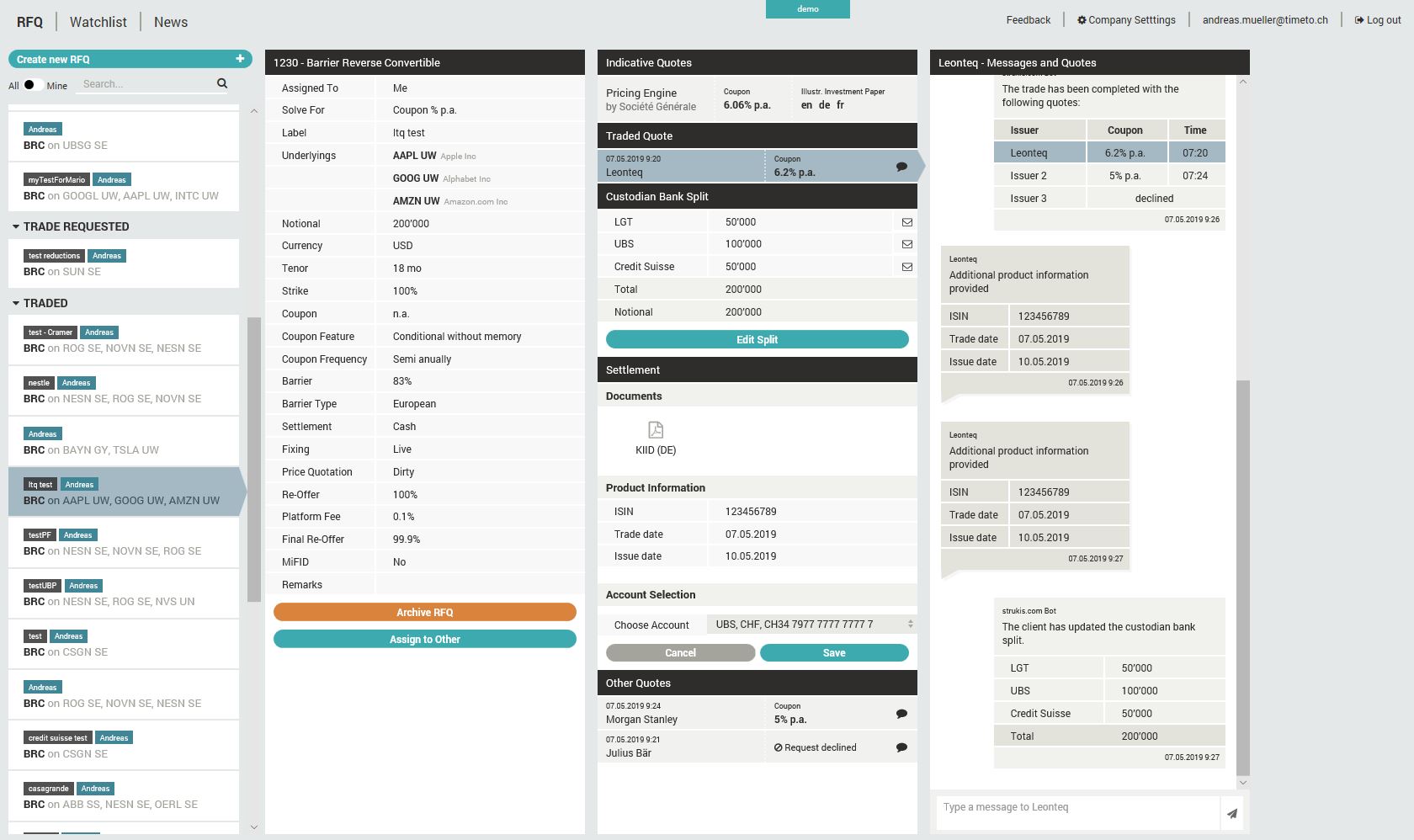

- Request for Quote - beauty contest and chat function directly with the trading desk.

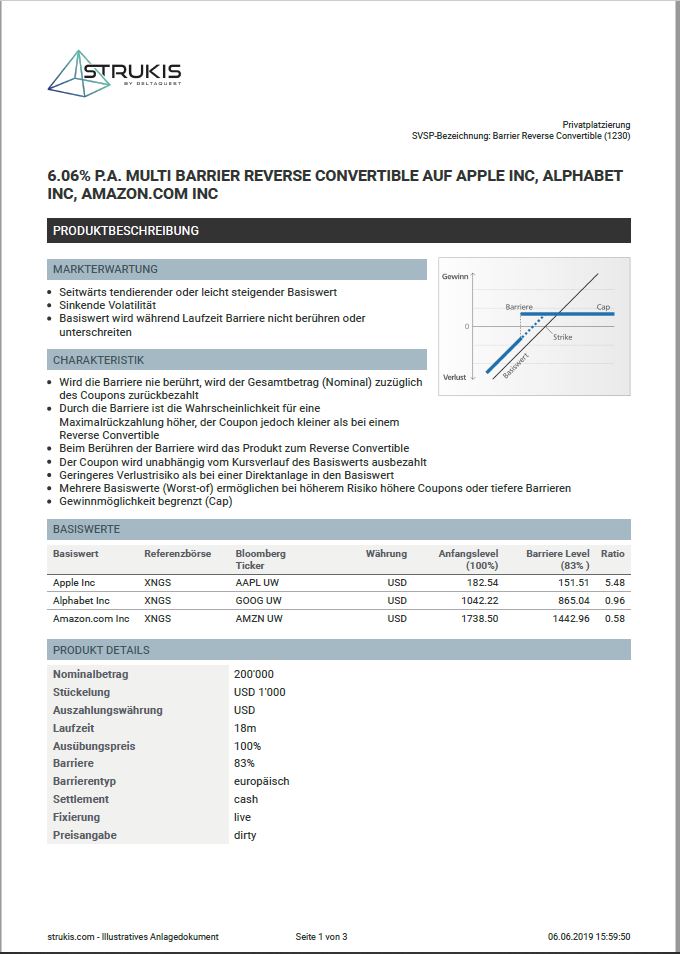

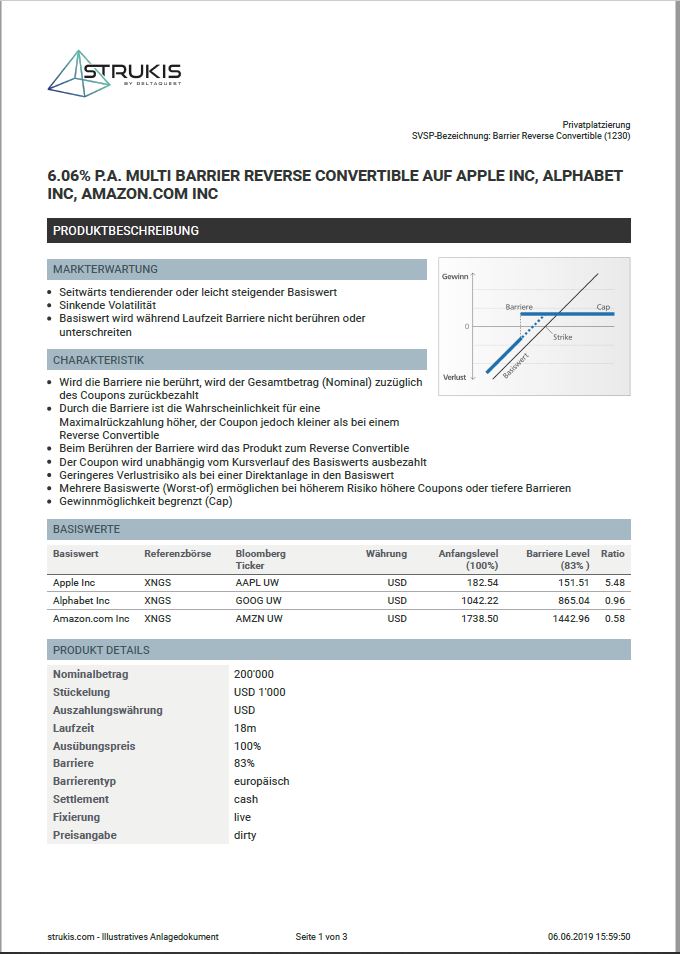

- Illustrative investment paper - customized for your product

- Trading - closing and settlement directly with issuers

- Aftersales lifecycle management

Description

How it works:

We assist asset managers, family offices, banks and institutional investors in a professional way to both configure the desired structured product and to find the most suitable issuer with the best possible offer.

strukis.com offers an independent, end-to-end transparent multi-issuer platform, where customers can use self-explanatory functions to create their own products and negotiate directly with various providers. Every single step in the value chain of structured products trading can be handled through strukis.com. In exchange for a fixed ticket fee, it is ensured that negotiations are conducted transparently over the entire course of the business and that the interests of suppliers and customers are optimally met.

Transparent

Strukis is 100% transparent. We apply a fix ticket fee compared to the standard industry percentage commission and every issuer has the same conditions.

Easy to use

Strukis was built with support of qualified financial market experts having extensive experience in structured products.

Independent

Strukis is the first fully independent multi-issuer platform. We have no conflict of interest. We do not focus on which issuer wins, but on how the issuer wins.

Life-Cycle Management

Strukis has developed its own software that simplifies the monitoring and analysis of structured products. You have access to your products at any time via our platform.

Live - Chat

Strukis provides a live chat between customer and issuer. As a customer you're always able to directly contact, ask and challenge the issuer about your requested product.

The story behind:

As an industry outsider, Andreas Müller (Dipl.-Ing. FH) learned about the problem of opaque business transactions in structured products during the end of 2016. With the firm intention to create an authentic, independent and completely transparent platform for this trade, Andreas Müller founded together with supporters of the industry the company DeltaQuest AG.

For the programming of strukis.com, the new product for the innovative restructuring of the asset management process, we, the company DeltaQuest AG, have joined forces for a closer cooperation with the company Codeplant GmbH. Codeplant GmbH has been specializing in the industry for several years. The considerable experience Codeplant GmbH already has in the structured products trading business will help us to create a long-term alternative to the asset management market. Together, our two companies can draw on a large repertoire of IT experience, which, together with the young age of all involved entrepreneurs, is the optimal prerequisite for building an online platform according to modern standards. We firmly believe only a fundamentally innovative project like strukis.com can be able to usher in the next era of business with structured products.

Company description

strukis.com was founded by DeltaQuest in 2017 and is based in Zurich. Our company is a first-in-class financial startup with the aim to disrupt and straighten the market of structured products. The first step to a transparent market has been achieved. With this we want to close the gap in the market and offer banks and external asset managers a real alternative for designing and trading structured products – and all this at very favorable conditions.

Preview

Key features

Key features

- Generate trading ideas for structured products

- Request for Quote - beauty contest and chat function directly with the trading desk.

- Illustrative investment paper - customized for your product

- Trading - closing and settlement directly with issuers

- Aftersales lifecycle management

Description

Description

How it works:

We assist asset managers, family offices, banks and institutional investors in a professional way to both configure the desired structured product and to find the most suitable issuer with the best possible offer.

strukis.com offers an independent, end-to-end transparent multi-issuer platform, where customers can use self-explanatory functions to create their own products and negotiate directly with various providers. Every single step in the value chain of structured products trading can be handled through strukis.com. In exchange for a fixed ticket fee, it is ensured that negotiations are conducted transparently over the entire course of the business and that the interests of suppliers and customers are optimally met.

Transparent

Strukis is 100% transparent. We apply a fix ticket fee compared to the standard industry percentage commission and every issuer has the same conditions.

Easy to use

Strukis was built with support of qualified financial market experts having extensive experience in structured products.

Independent

Strukis is the first fully independent multi-issuer platform. We have no conflict of interest. We do not focus on which issuer wins, but on how the issuer wins.

Life-Cycle Management

Strukis has developed its own software that simplifies the monitoring and analysis of structured products. You have access to your products at any time via our platform.

Live - Chat

Strukis provides a live chat between customer and issuer. As a customer you're always able to directly contact, ask and challenge the issuer about your requested product.

The story behind:

As an industry outsider, Andreas Müller (Dipl.-Ing. FH) learned about the problem of opaque business transactions in structured products during the end of 2016. With the firm intention to create an authentic, independent and completely transparent platform for this trade, Andreas Müller founded together with supporters of the industry the company DeltaQuest AG.

For the programming of strukis.com, the new product for the innovative restructuring of the asset management process, we, the company DeltaQuest AG, have joined forces for a closer cooperation with the company Codeplant GmbH. Codeplant GmbH has been specializing in the industry for several years. The considerable experience Codeplant GmbH already has in the structured products trading business will help us to create a long-term alternative to the asset management market. Together, our two companies can draw on a large repertoire of IT experience, which, together with the young age of all involved entrepreneurs, is the optimal prerequisite for building an online platform according to modern standards. We firmly believe only a fundamentally innovative project like strukis.com can be able to usher in the next era of business with structured products.

Company description

strukis.com was founded by DeltaQuest in 2017 and is based in Zurich. Our company is a first-in-class financial startup with the aim to disrupt and straighten the market of structured products. The first step to a transparent market has been achieved. With this we want to close the gap in the market and offer banks and external asset managers a real alternative for designing and trading structured products – and all this at very favorable conditions.

Preview

Preview