ABAKA Artificial Financial Intelligence Platform

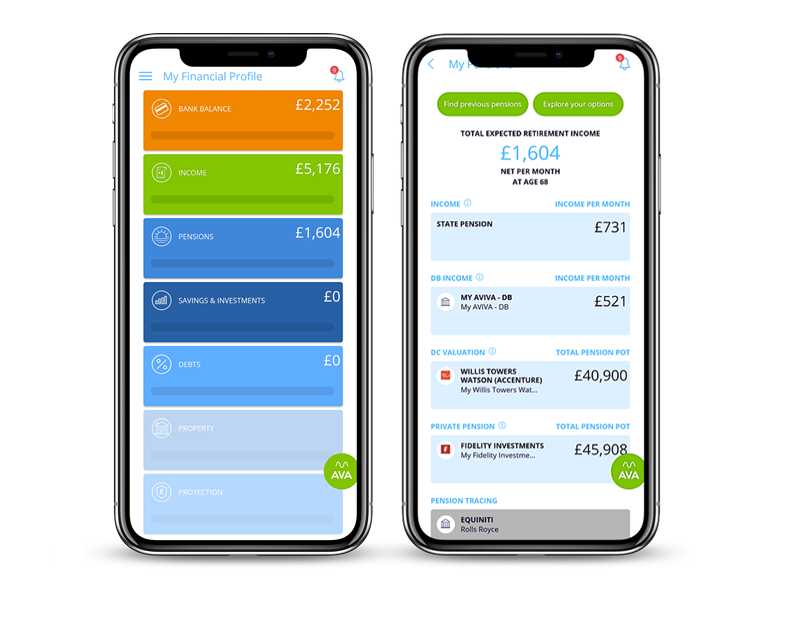

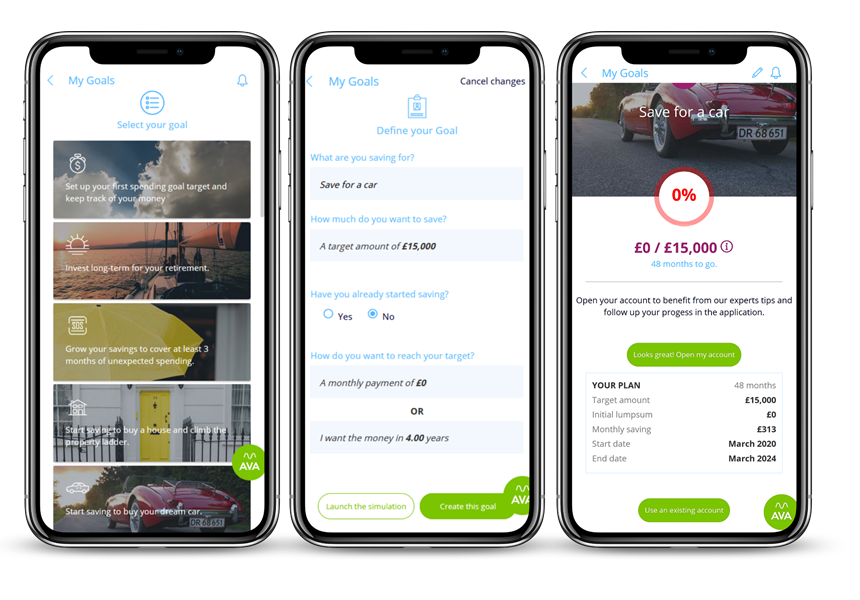

ABAKA is global leader in digital saving & retirement SaaS solutions, powered by AI. Our cloud technologies & modular apps enable financial institutions to power digital saving & retirement solutions delivering scalable & affordable advice on retirement, savings & investments to retail customers

Key features

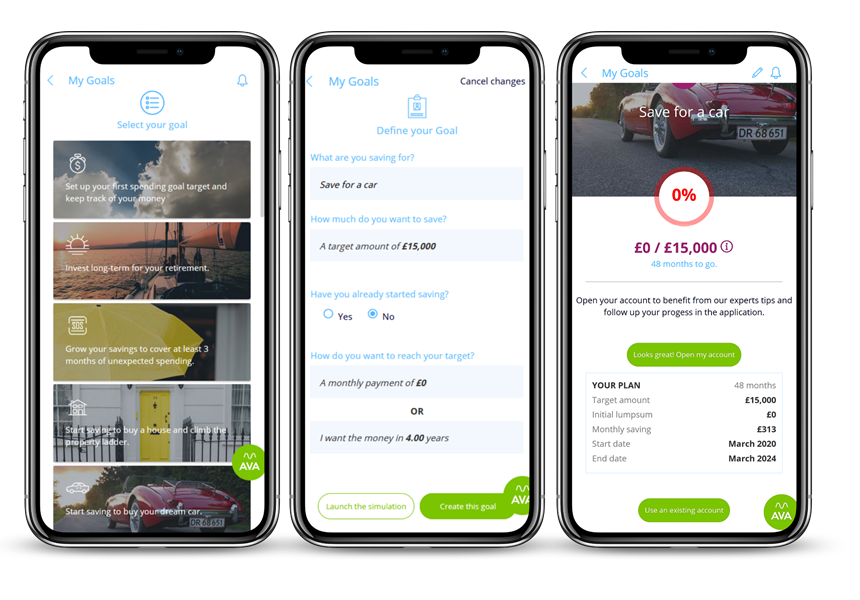

- Intelligent Nudges: Hyper-personalised nudges to accurately activate your customers

- Conversational AI: deep domain specific knowledge on retirement, savings & investments

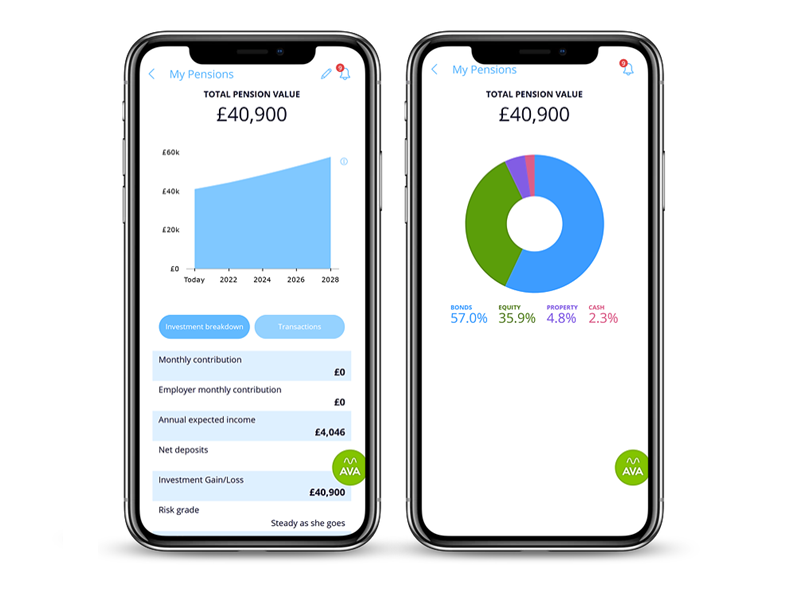

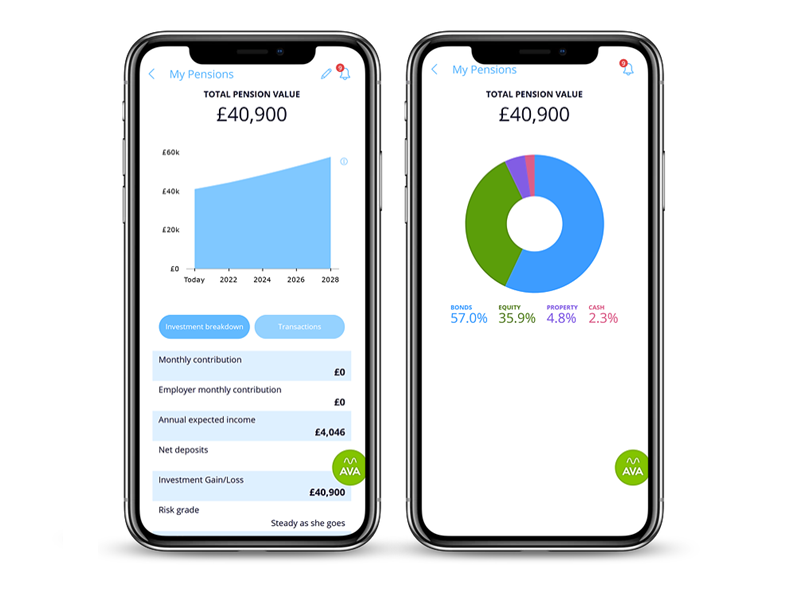

- Financial Engine: customisable MonteCarlo stochastic modeller for accumulation and decumulation

- Data aggregation: global current/checking, savings, general investment & retirement accounts (workplace & private)

- Financial Literacy: Large library of financial content to educate and empower customers

Key features

Key features

- Intelligent Nudges: Hyper-personalised nudges to accurately activate your customers

- Conversational AI: deep domain specific knowledge on retirement, savings & investments

- Financial Engine: customisable MonteCarlo stochastic modeller for accumulation and decumulation

- Data aggregation: global current/checking, savings, general investment & retirement accounts (workplace & private)

- Financial Literacy: Large library of financial content to educate and empower customers

Description

Preview