ACTICO Decision Management; Model & Execute Rules

Key features

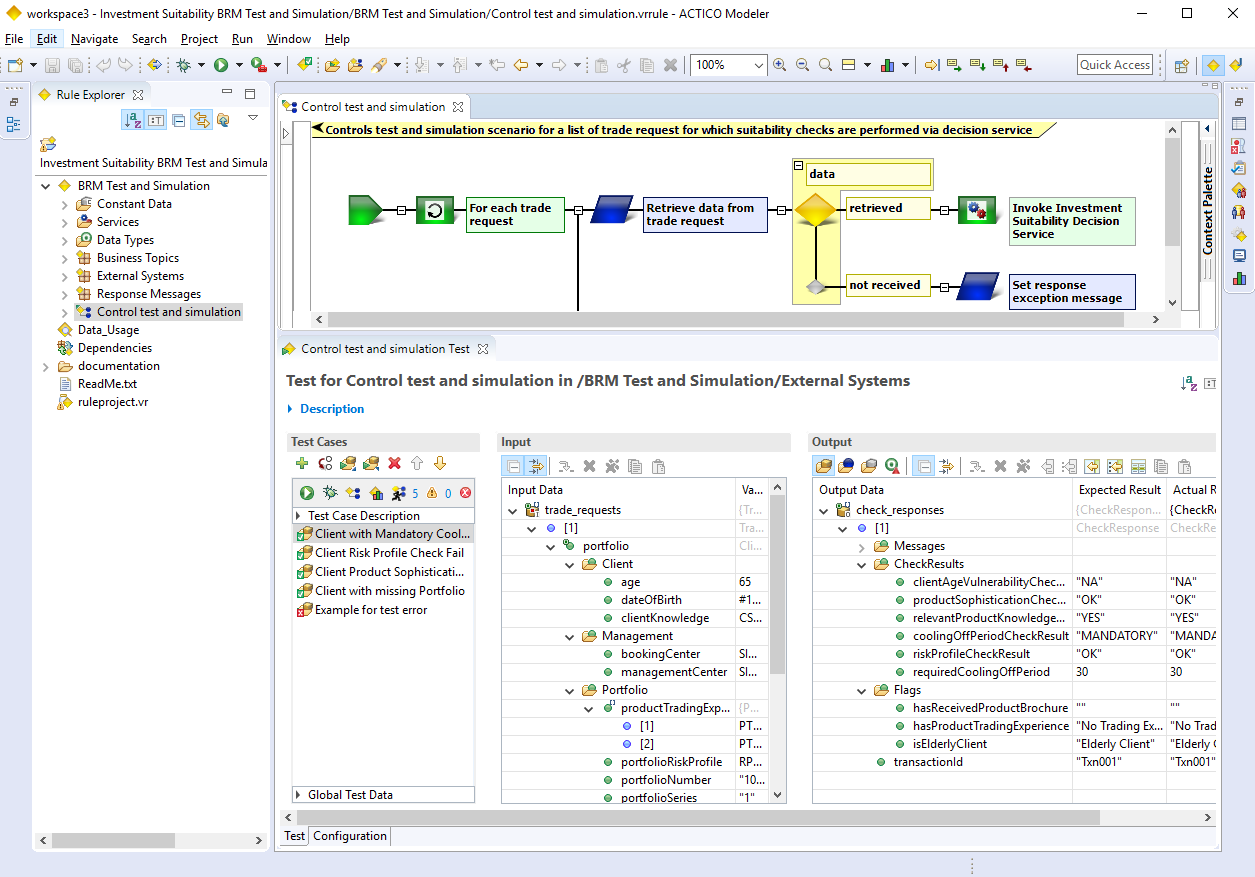

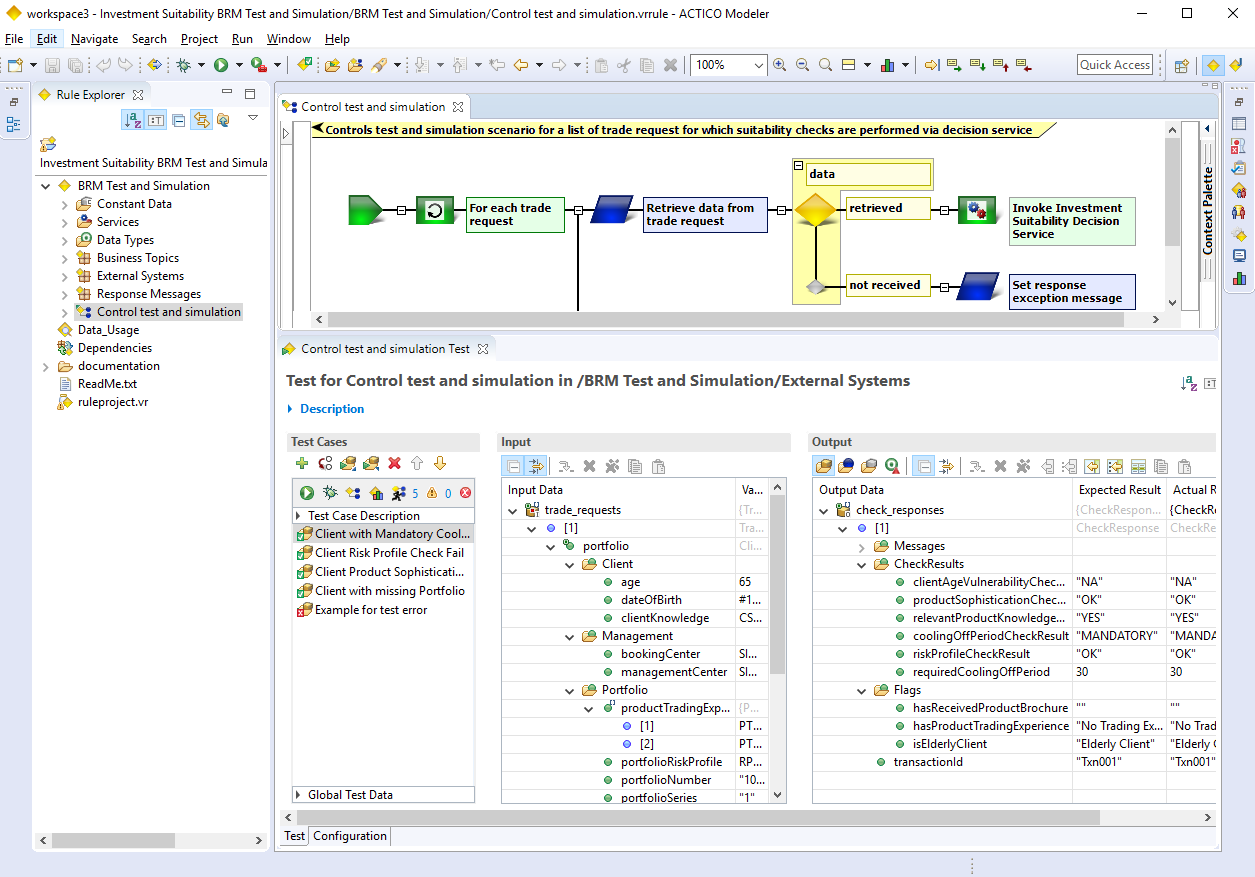

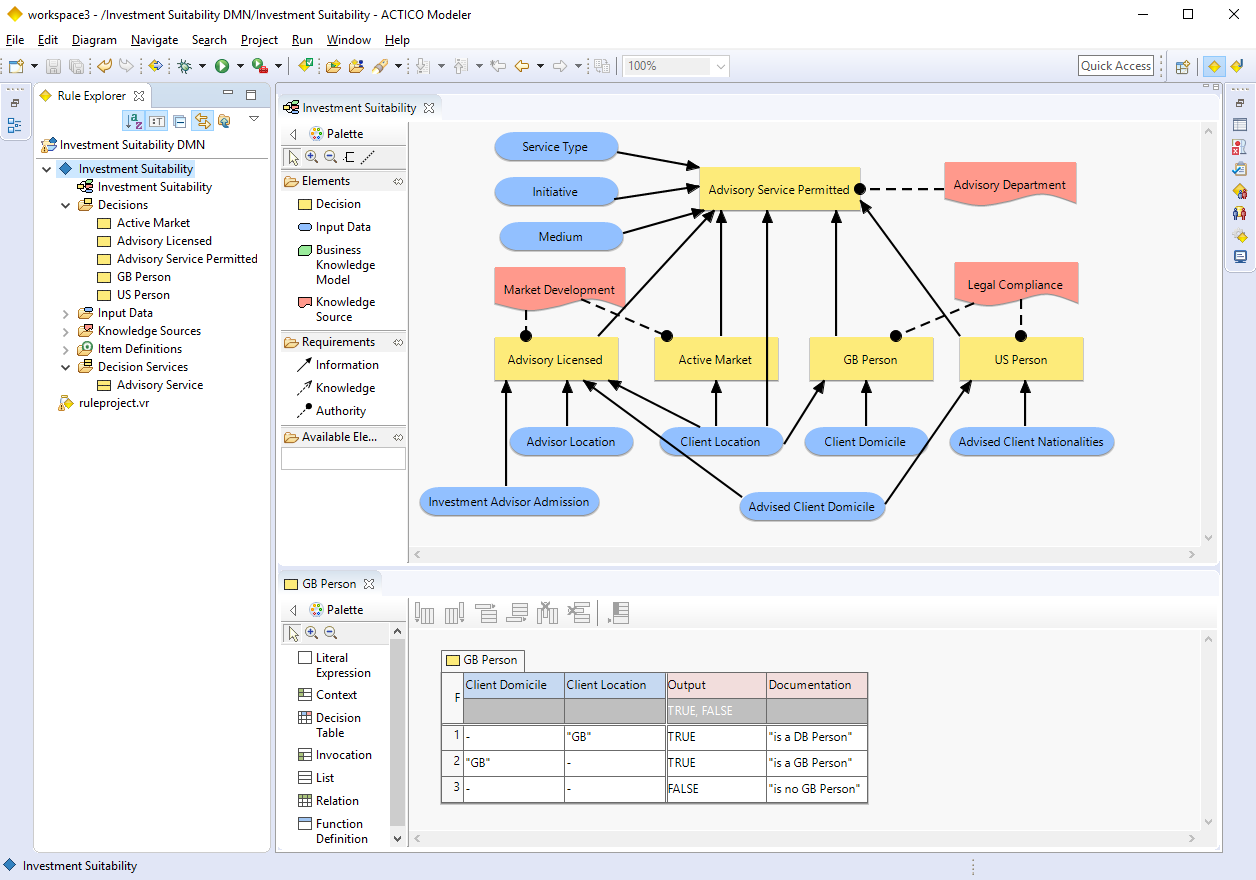

- Intuitive graphical modeling, management and testing of decisions and business rules. No programming required.

- Enables business domain experts to create and maintain their decisions and business rules transparently.

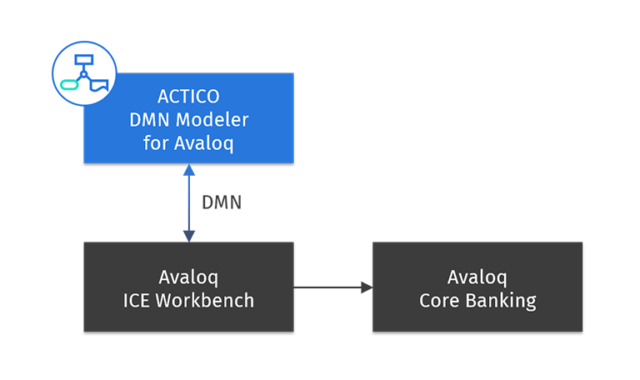

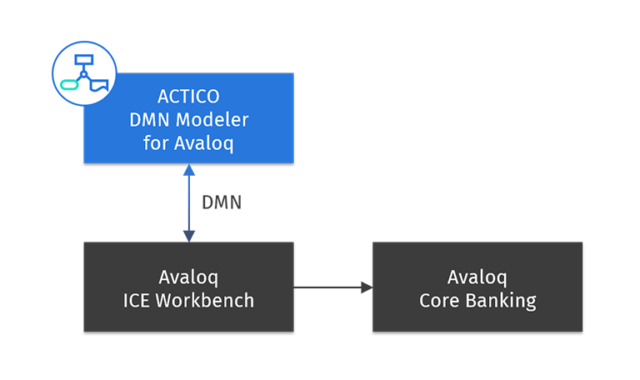

- The Avaloq BRE Standard Adapter transfers the business rules into the Avaloq Business Rules Engine

- Business departments can read the graphical rules. Rule modifications always remain transparent.

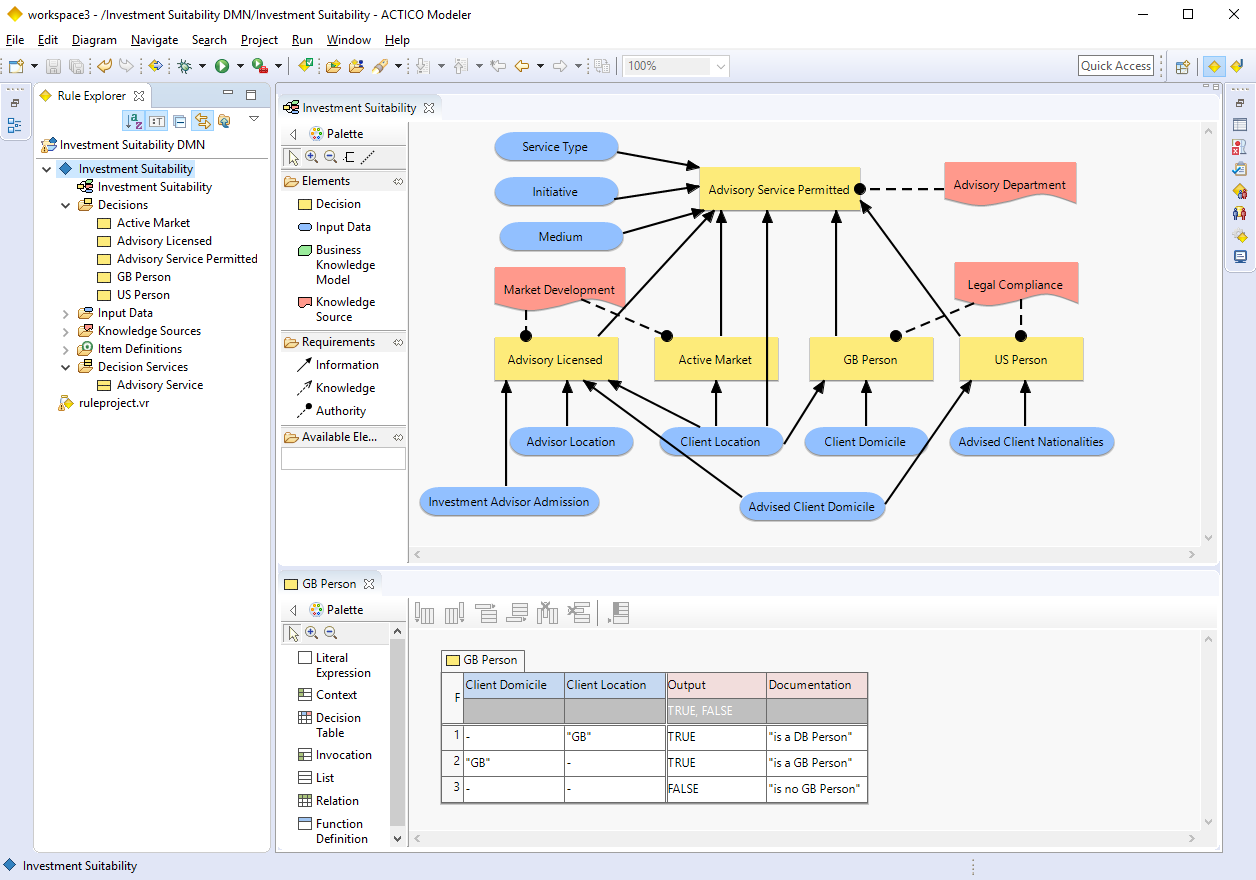

- Applicable for various use cases: Investment Suitability, simulation of cost and fees, Client Lifecycle Management

Documents

Model business rules in ACTICO Decision Management and execute them in the Avaloq Banking Suite

Transparent and revision-proof management of investment suitability rules

Software for digital automation in the banking, financial services and insurance industry

Key features

Key features

- Intuitive graphical modeling, management and testing of decisions and business rules. No programming required.

- Enables business domain experts to create and maintain their decisions and business rules transparently.

- The Avaloq BRE Standard Adapter transfers the business rules into the Avaloq Business Rules Engine

- Business departments can read the graphical rules. Rule modifications always remain transparent.

- Applicable for various use cases: Investment Suitability, simulation of cost and fees, Client Lifecycle Management

Description

Preview

Documents

Documents

Model business rules in ACTICO Decision Management and execute them in the Avaloq Banking Suite

Transparent and revision-proof management of investment suitability rules

Software for digital automation in the banking, financial services and insurance industry