Discussing investments with clients is done differently now. Hybrid ways of managing wealth, which complement classic advisory with such innovations as conversational banking, are proliferating. The task for banks and wealth managers is to balance client demands for a rich, flexible, premium experience with the need to keep costs under control. This is where Avaloq can help.

Investors decide for themselves

A hallmark of the digital revolution in financial services is the widespread access to information it has made possible. A key consequence of such access is how it has inspired investors worldwide to become more hands on with their wealth. A recent survey conducted by Avaloq in Europe and Asia Pacific reveals how comprehensive this trend is.

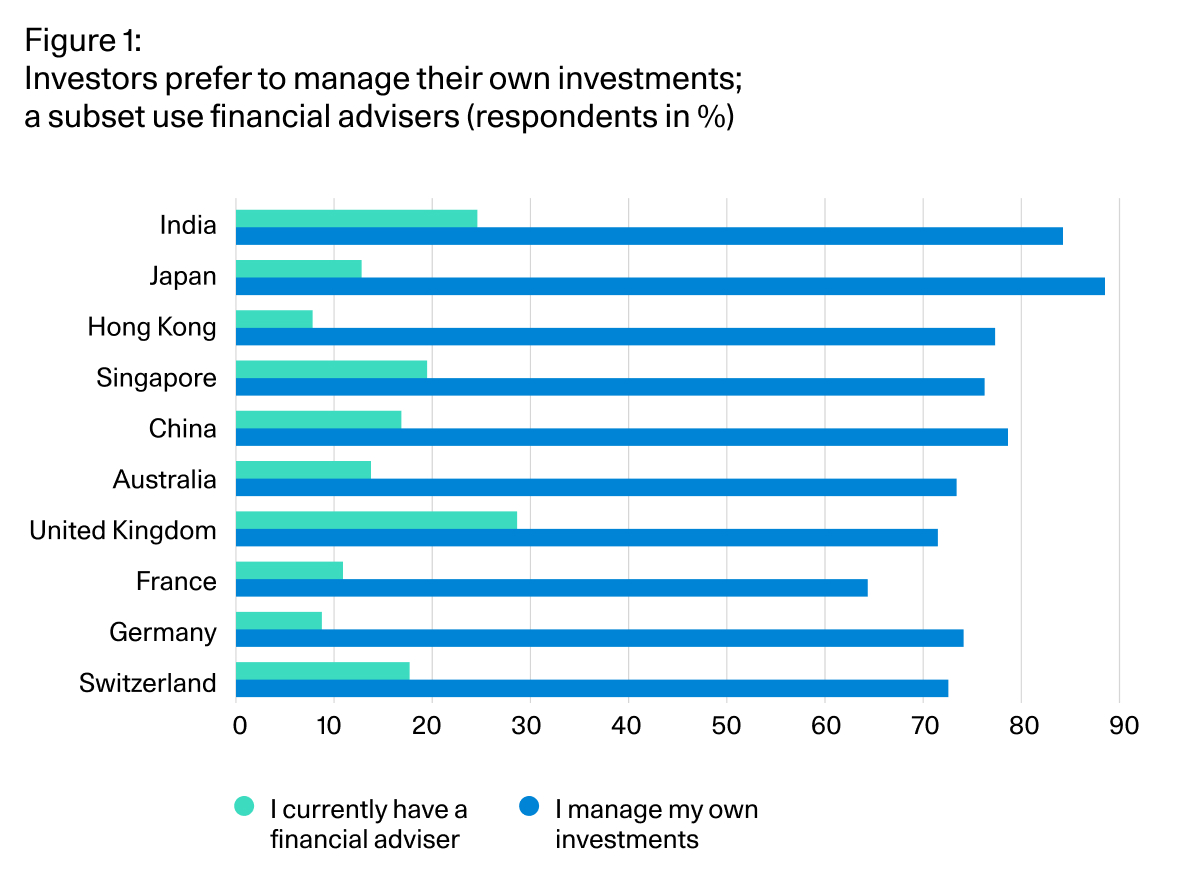

Roughly three-quarters of the affluent and wealthier investors we surveyed, whether resident in the UK, Germany, France, Switzerland, India, China, Japan or Australia, said they manage their own financial decisions (see figure 1). The percentages were markedly consistent across countries.

Interestingly, what varied is the percentage of respondents who stated that they use a financial adviser. These specialists, however, are being employed to assist investors with choosing among investment options. Most decisions are not being delegated entirely, as investors hire advisers to complement their decision-making process.

Mobile banking making inroads

While web banking is almost universally popular with investors, the demand for mobile and other advanced digital capabilities differs notably by country and region. Asian investors welcome them most: nearly 80% of respondents in China and 70% in India, for instance, consider a state-of-the-art mobile banking app essential (see figure 2). Interestingly, this desire for mobile ease and convenience does not lessen expectations for a highly personalized service. In most markets, investors want their bank to offer access to digital channels as well as individualized advice.

Beyond that, a full third of those surveyed in China, Singapore and Hong Kong regard conversational banking and the ability to use popular social messaging apps to communicate with their wealth manager as one of the most exciting capabilities to have in digital banking. While we do not yet see the same level of enthusiasm for these services in Europe, Japan or Australia, as Western investors familiarize themselves with the new capabilities and come to appreciate their advantages, evidence is mounting of growing interest in them.

Adapting to digital disruption

This week’s fintech breakthrough will not be the last. Innovation in the financial services industry is here to stay. Banks and wealth managers, in our view, need to find the right balance between what technology and what talented staff can offer their clients to ensure long-term success. Robo-advisory is being integrated into traditional methods of managing wealth, and for good reason. It, along with artificial intelligence (AI) more broadly, can improve customer service, automate repetitive tasks and even provide personalized investment advice.

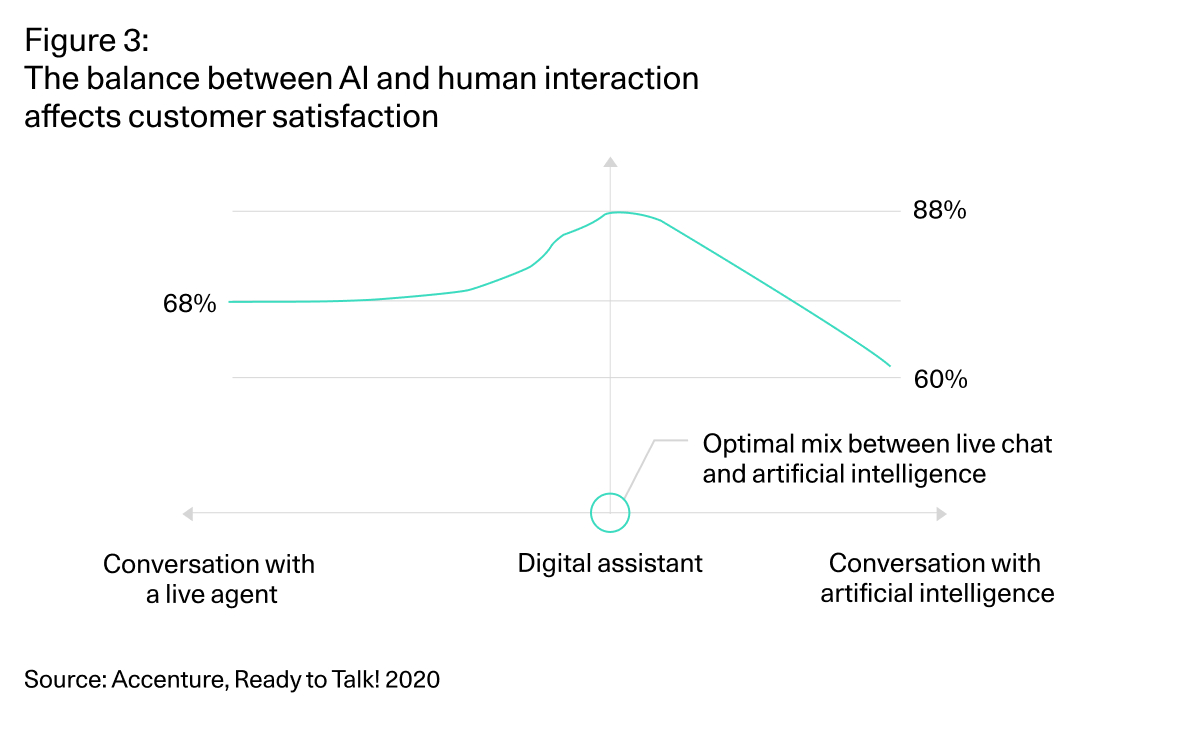

A clear majority of investors, according to our surveys and the observations of consultants (see figure 3), do not want to use an exclusively “robotic” service, though. They still appreciate the human component, especially in advice. Finding this sweet spot between human interaction and digitally based support for clients is the challenge banks face.

A hybrid wealth management solution of AI-supported client engagement by the adviser is likely to become the premium standard. The benefits of it are obvious: greater operational efficiency and a faster, richer client experience.

Advisory informed by millennial preferences

We envision most wealth managers developing a hybrid model that blends automation and digital availability with classic advisory. Digital natives are less keen on meeting in person than previous generations, a predilection that stems not merely from Covid restrictions. As they age and accrue more wealth they are likely to cling to ways of communicating that they are comfortable with, including through favoured messaging services.

Transform your client experience

Discover how Avaloq's digital experience capabilities can elevate your client interactions and drive engagement. Explore the innovative functionalities we offer to enhance your business.