If you maintain a sustainable lifestyle and set out to buy both tomatoes and an investment fund, you will quickly notice that your purchase decision regarding the vegetables is grounded in more fact than the one for the fund.

Labels such as “organic” or “fair-trade” for food are well established in consumers’ minds and are often strictly regulated by government law. On the contrary, a wealth of definitions and criteria for sustainable investments started to sail under the flag of ESG – the acronym for “environmental, social and corporate governance” factors. These uncertainties, combined with a double-digit market growth in sustainable investment products, triggered financial authorities to tighten their grip on sustainable investing.

The rise of ESG

Indeed, the real turning point for ESG investing came in the current century – more specifically, in the past five years. It was triggered by a new generation of investors for whom sustainability and purposefulness became commonplace values in a society increasingly spurred by environmental, health and safety awareness.

This quickly materialized in increasing volumes of traded funds and ETFs, managed along ESG criteria. However, without a global standard for defining an ESG asset, the attempt to size the growth of ESG investing is made difficult, with research revealing a wide range of contradictory figures.

And with that, we have arrived at the core of all regulatory efforts – the goal to develop a standardized taxonomy and criteria for ESG.

ESG is an increasingly influential factor in the financial reporting of companies and the investment process of investors. However, the lack of standardized rules for the disclosure of ESG factors by companies impedes the consolidation of ESG data and its integration into investment tools.

Given the significant market momentum, most regulators now recognize the importance of common rules for the ESG investment market and have started to outline ESG rules for the financial reports of companies. Some regulations will not stop at the companies’ annual reports and will further define the labelling and transparency of investment products, whether they sail under the flag of ESG or other promises of sustainability.

The market has reached a point where not only consumers ask for binding criteria, but also institutional investors and asset managers realize that the current uncertainty is a limiting factor for further business growth. A good reason to dive into a review of current growth and regulation efforts in some of the world’s major financial markets.

ESG investing in the US

The share of ESG-mandated assets in the US rose to 26% in 2018. Deloitte expects this figure to reach 50% of all professionally managed assets by 2025. The current volume of USD 12 trillion is only exceeded by the sum of investments in Europe, where USD 14.1 trillion are invested into ESG-compliant assets. While Europeans hold the highest absolute amount of ESG investments, recent growth in this space was fuelled by the double-digit compound annual growth rate (CAGR) of the US market. [1]

As early as 2018, some institutional investors asked the Securities and Exchange Commission (SEC) to develop rules to harmonize ESG investments. They felt that a consistent taxonomy for “environmental,” “social” and “corporate governance” would help generate more efficiency between public companies and asset managers, as well as between asset managers and their clients.

These efforts came to fruition in January 2020, when Congress tasked the SEC with building a “Sustainable Finance Advisory Committee” with the mission to define binding SEC disclosure rules for the reporting of ESG factors. The committee is expected to come up with a proposal by mid-2021. [2]

Besides the newly formed committee, a growing number of Democratic senators, like Chuck Schumer or Elizabeth Warren, along with private NGOs and accelerators like the Ceres Accelerator for Sustainable Capital Markets, are keeping the pressure high on the SEC and other regulatory commissions. [3]

We can conclude that, while climate change and sustainability remain controversial topics on a governmental level, the US financial industry has started to recognize the importance of ESG disclosure rules. An aligned view on ESG disclosure rules is a precondition for building an offering that meets private and institutional clients’ future demand for ESG-aligned investing.

ESG investing in Switzerland

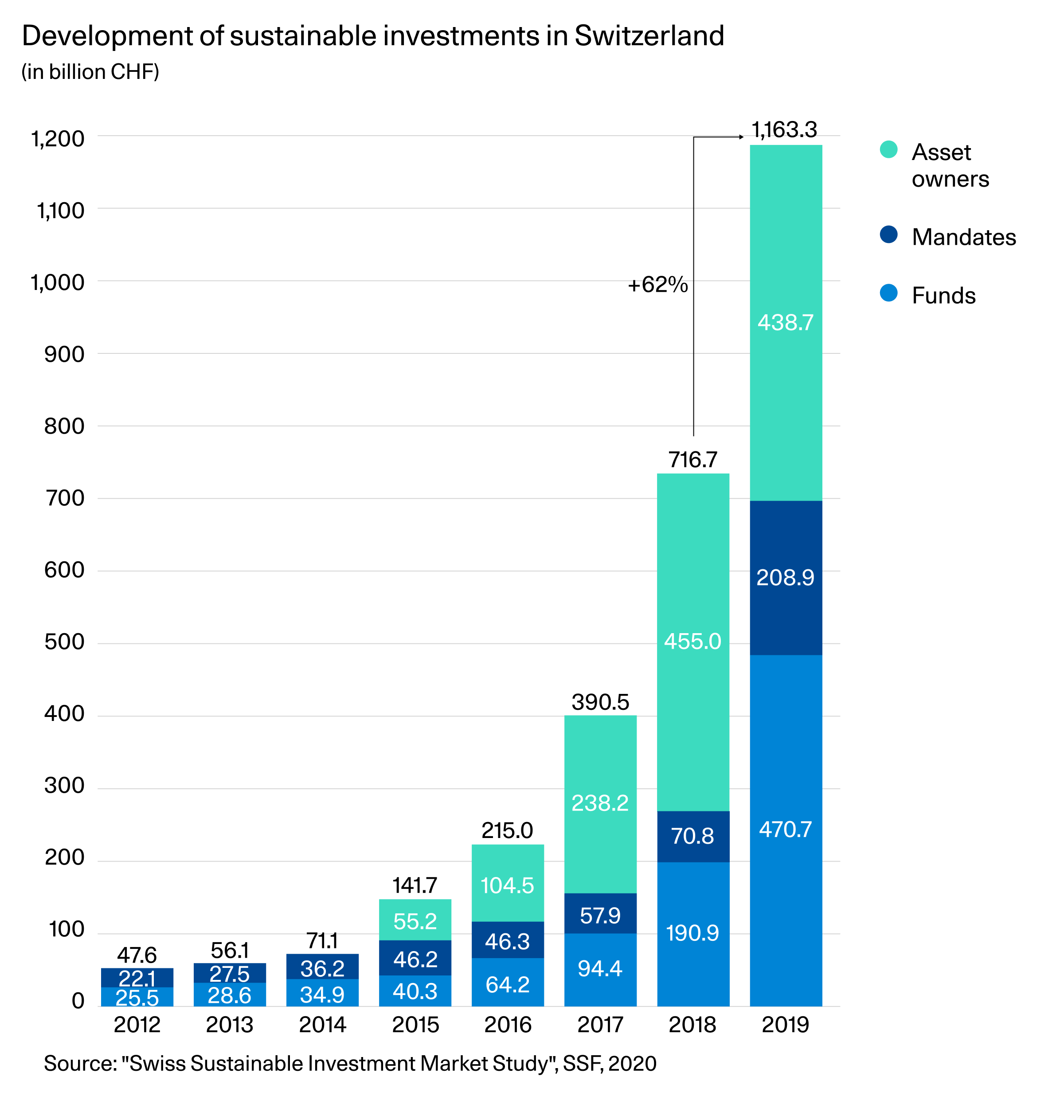

ESG investing has reached the Swiss market in force. A study by Swiss Sustainable Finance (SSF) reports CHF 1,163 billion (USD 1,269 billion) of sustainable investments in 2019. This represents an increase of 62% compared to the previous year and an almost exponential growth in the past five years, with no end in sight. [4]

The Swiss Federal Council has set the ambitious climate target of reducing carbon emissions to net zero by 2050. While this goal does not yet contain specific obligations for the financial sector, the government expects Swiss investors to invest in such a way as to not counteract climate goals.

Currently, only two legislative frameworks on a national level are linked directly with sustainable investing. The Executive Pay Provision sets disclosure rules and other corporate governance principles in the field of top management compensation. The Federal Act on War Materials limits the export of armaments goods. A pending public initiative, to be voted on in November 2020, seeks to ban investments of pension funds and the Swiss National Bank in the weapons industry altogether.

In 2019, the Swiss government tasked an internal workgroup to examine Switzerland’s participation in international sustainable investment initiatives and how developments in the EU (see next chapter) will affect the Swiss financial centre. The workgroup published an in-depth report in June 2020, with an assessment of international ESG initiatives. The report will be instrumental in the processing of current and future parliamentary requests and postulates. In 2019 alone, 28 such items were submitted by the Swiss Parliament, keeping ESG investing at the top of current legislation topics. [5]

ESG investing in the European Union

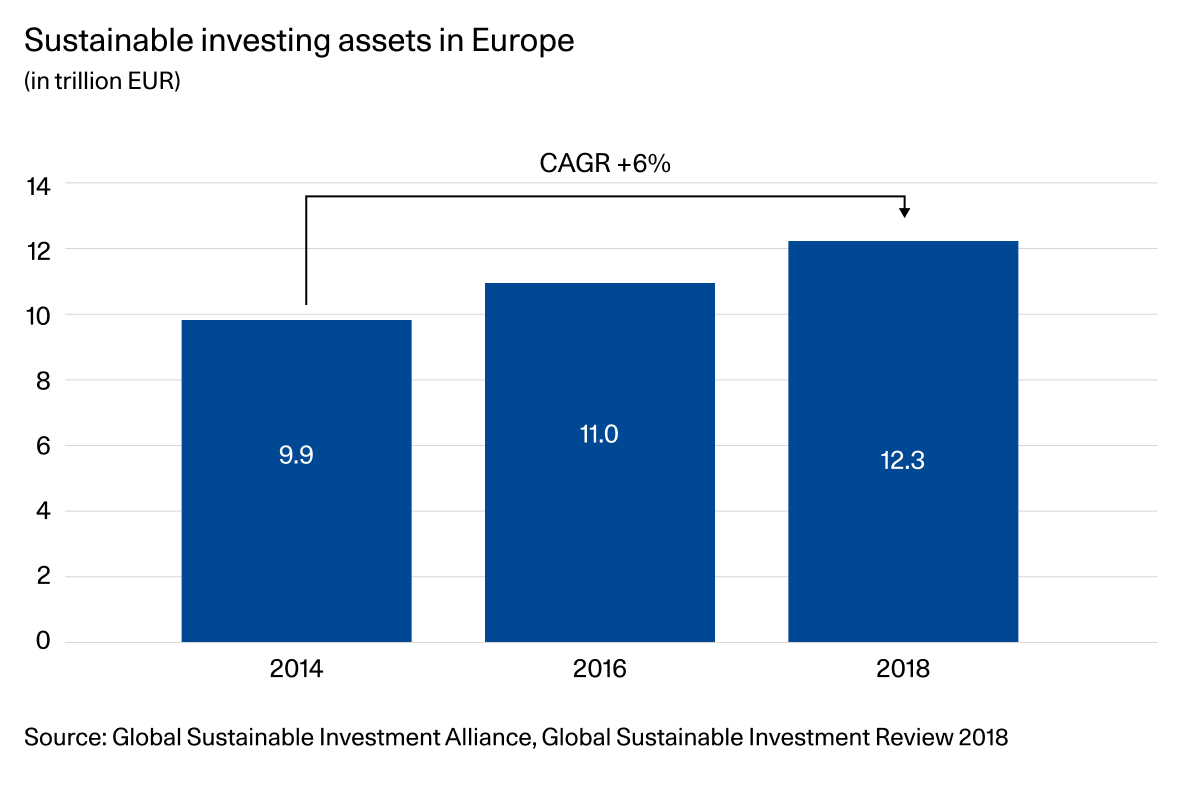

As mentioned in the comparison with US figures, the ESG investment volume in Europe was estimated by Deloitte at USD 14.1 trillion in 2018. [1] This is supported by other sources, such as the Global Sustainable Investment Alliance [6], which reported assets of EUR 12.3 trillion for Europe in 2018 and a CAGR of 6% since 2014.

As it did with the revised Payment Services Directive (PSD2) regulation to foster open banking, the EU has set out to define rules and create a framework to help ESG investments flourish. The approach is far-reaching and detailed, as we have come to expect from previous EU financial regulation. Announced by the European Commission in 2018, the European Securities and Markets Authority (ESMA) has outlined two major elements for their ESG regulatory framework. The two key sets of rules are the EU Taxonomy Regulation (2018/0178 (COD)) and the Regulation on Disclosures (EU/2019/2088) – referred to as the Sustainable Finance Disclosure Regulations (SFDR).

The Taxonomy Regulation aims to establish an EU-wide classification system to provide clarity on the degree to which economic activities of a company can be considered environmentally sustainable. It will harmonize standards for the classification of investment products labelled as “green” or “sustainable” and put an end to companies’ efforts of “greenwashing” their businesses. The Taxonomy Regulation will apply from 31 December 2021.

The SFDR also has direct consequences for all companies, including investment firms and asset managers. It requires the firms in scope to disclose ESG factors during their investment decision-making processes for all investment products within the EU. Additional requirements apply when the products are specifically promoted as sustainable, green or have set ESG factors as part of their investment objectives. The majority of the SFDR provisions will apply from 10 March 2021. Investment firms will need to declare, at product level, the likely impacts of sustainability risks on the returns of each financial product or explain why they consider sustainability risks not to be relevant for a particular product. This has far-reaching consequences for the investment process and will be reflected in amendments of MiFID, AIFMD and UCITS regimes. The European Commission published the first drafts of the amendments in June 2020.

The EU regulatory frameworks on ESG are far-reaching and will help to standardize sustainable investing over the coming years. However, the high level of detail and the accelerated implementation prevent the market from developing its own definitions along the forces of supply and demand.

ESG investing in Asia

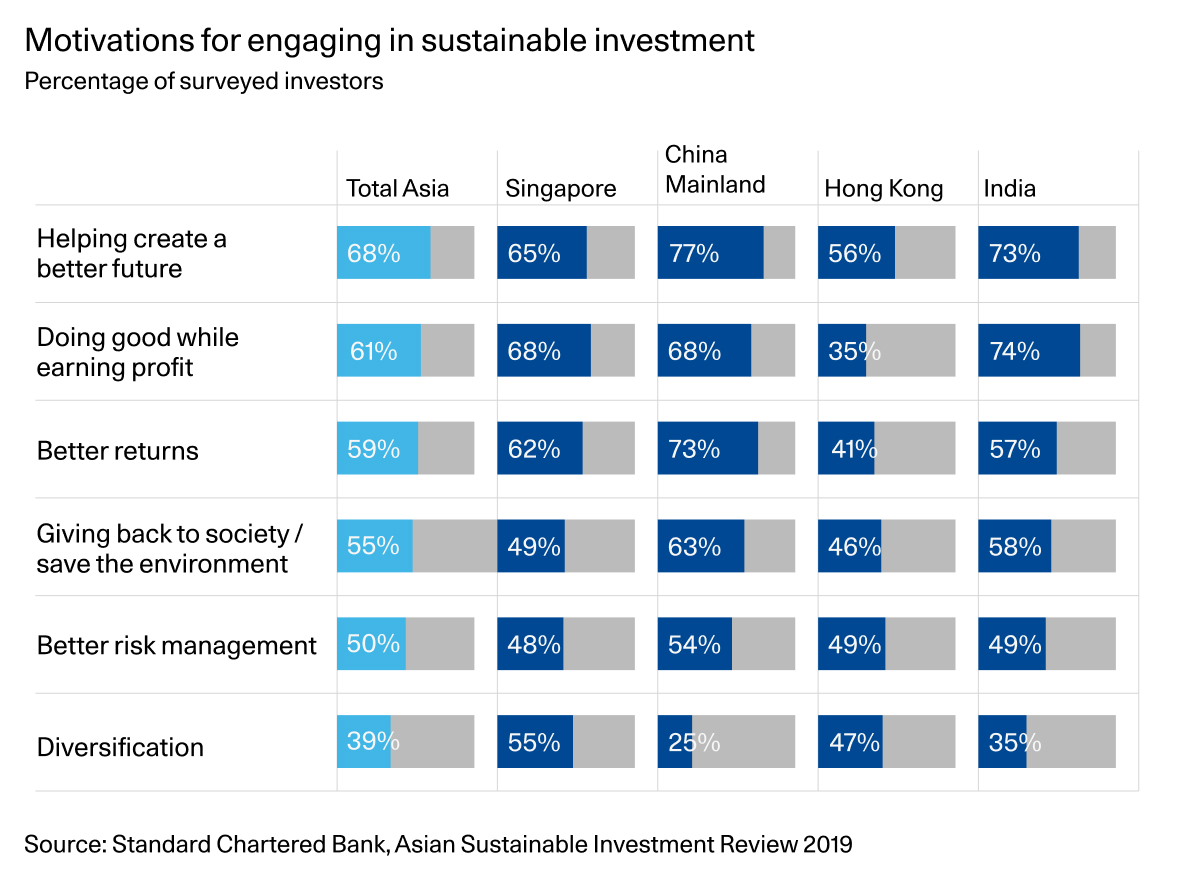

Differences exist in the adoption of sustainable investing in the various Asian markets. While asset volumes are still observed to be lower than in Europe or the US, growth picked up speed over the last few years. Some reports even attest three-digit growth rates to markets such as Japan. [7] Besides the asset volume, motivations to invest in sustainable assets reveal the current movement in the market. Completely altruistic intentions, such as helping to create a better future or helping save the environment, are supplemented by the goal of achieving better returns.

Clearly, Asian investors started to embrace the idea that unsustainable businesses constitute a long-term investment risk and many sustainable assets contain a chance of outperforming traditional assets. The motivation to “do good while earning a profit” is among the highest in Singapore and mainland China, where authorities have started to foster ESG disclosure of companies with new regulation.

Singapore was among the first financial markets to recognize the value of ESG standards. Sustainability reporting was mandated as early as 2016 for listed companies and fostered investor confidence in ESG data. The early adoption of ESG standards is deemed to be one of the success factors of Singapore’s stock market. [8] In November 2019, the Monetary Authority of Singapore laid out plans to invest USD 2 billion in developing the country as a green finance hub and promoting sustainable financing in the financial sector. [9]

The Chinese government announced, in 2018, the ambition to increase transparency and standardization in the disclosure of ESG-related risks. However noble the intentions were then, today, Chinese mainland companies face no fewer than nine sets of ESG reporting guidelines, issued by a mix of financial regulators, non-financial regulators and stock exchanges. In their misery, companies turn to private ESG ratings providers, further adding to the confusion among domestic and foreign investors. A study found an average correlation between pairs of ratings issued by four major domestic and international providers of just 0.33, compared with 0.99 between credit ratings from Moody’s and S&P. [10]

Similarly, Hong Kong seeks to position itself as a regional hub for sustainable investments. The Hong Kong Monetary Authority (HKMA) introduced several measures in these areas in 2019. The local stock exchange regulator (HKEX) introduced ESG-focused listing requirements, enhanced corporate governance and transparency, and updated its reporting guidelines.

Many more countries in the Asia-Pacific region have decided to introduce ESG standards for company disclosures or are in the midst of the political processes to do so.

Conclusion

The approach of regional regulators to ESG may differ and follow individual timelines. But they all strive for the ultimate goal of enhancing transparency for investors. Standardization at a local level will need some time to establish itself and the global mobility of investors and investment firms will further instil a drive towards global standards.

Wealth managers have to closely observe developments in their markets and make sure they upgrade their platform to support the inclusion of ESG factors into investment decisions. A further requirement should be a free choice of the data source for the ESG module in a wealth management platform. This allows for flexibility and the ability to amend the data source with some agility, should local regulation demand adherence to new standards.

Democratization of wealth management: a unique business opportunity

Learn more about:

- The four megatrends and what they mean for the financial industry

- How innovation, industrialization and individualization are key to mitigating structural margin pressure

- How the shift of wealth to a new generation will shape client needs

- Why the affluent segment poses a significant business opportunity for wealth managers