What role will business process as a service (BPaaS) play in banking as we move into the new decade? Here are the four biggest benefits that BPaaS offers to banks.

In this article, we will focus on four advantages of a BPaaS solution and their significance for banks and wealth managers in the coming years. The recent pandemic has put the operating models of financial institutions to an unwelcome test. After years of focusing on efficiency and automation, banking operations teams worldwide had to manage the impact of lockdown rules and rapidly rising transaction volumes in volatile markets.

Discover how solid and future-proof operations provide the efficiency and reliability that wealth management businesses need to focus on what they do best – offering advice in uncertain times.

1. Focus on what generates your revenue

BPaaS solutions allow banks and wealth managers to focus on what is essential to their core business model, while dedicated service providers handle the rest. The last decade has witnessed the most rapid change in consumer behaviour ever, especially in terms of the channels they prefer to use to interact with banks, such as web and mobile banking or even social messaging.

This means that banks and wealth managers must focus increasingly on channel development and improving user experiences. Focusing on the advisory experience and scalability allows wealth managers to serve a growing affluent segment with personalized services, previously reserved only for (ultra-) high-net worth clients.

The task of enhancing internal operational efficiencies is a distraction in this process, claiming significant change management resources within a financial institution. This is where BPaaS services can come in handy, taking on the non-core activities. A service provider will not only operate these processes, but also ensure adaptation to new regulations and oversee the implementation of new innovations, like robotic process automation and artificial intelligence, in order to constantly increase reliability and efficiency.

2. Stay flexible and scale on demand

Cloud-based models obviously provide unparallelled scalability and flexibility. Clients can ramp up or reduce the resources available to them quickly. A good cloud provider should also offer the flexibility to rapidly make changes, using their dedicated and experienced personnel.

BPaaS models provide all of this and take it to the next level, as scalability and flexibility apply not only to hardware or software but also to entire business processes. This means that if a bank is running behind on customer onboarding during a particularly busy period, they can ramp up the processing volume for tasks handled by a BPaaS service provider to deal with the increased demand.

Another example of BPaaS model flexibility emerged with the start of the pandemic crisis earlier this year. Switzerland has historically taken banking secrecy very seriously, and in this strict environment, Avaloq, with its true Swiss heritage, developed a solution for relationship managers and banking personnel to access the information they need for their daily jobs remotely while staying compliant.

Avaloq clients embraced the option to add the Sensitive Data Segregation (SDS) extension within their Avaloq Banking Suite on short notice when lockdown rules started to affect their businesses. With the SDS extension active, they could separate the customer-facing processes from the back-office processes, ensuring the segregation of sensitive client data. This allowed bank staff to more easily work from home and, most importantly, it ensured compliance with local regulations during the lockdown.

3. Achieve cost efficiencies

Rather than looking only at the cost of implementing a solution, it is better to look at overall cost efficiencies gained. Implementing a more expensive, customized solution may or may not be better than a standard, off-the-shelf one. It depends entirely on the client’s needs. That is where the focus should be – meeting the client’s specific needs and offering a solution that works best for them.

The overall operational efficiency of banks, as measured by the cost-to-income (C/I) ratio, remained stagnant over the last five years. For European banks, the ratio has stalled at around 68-71% since 2015.[1] For Swiss banks, it shifted from around 55% in 2000 to 65% in 2018.[2] This is indeed a meagre return, given all the cost-saving efforts observed over the past years. The underlying reason is, of course, that with the current structural pressure on wealth managers’ margins, cost savings are constantly obliterated by shrinking revenues.

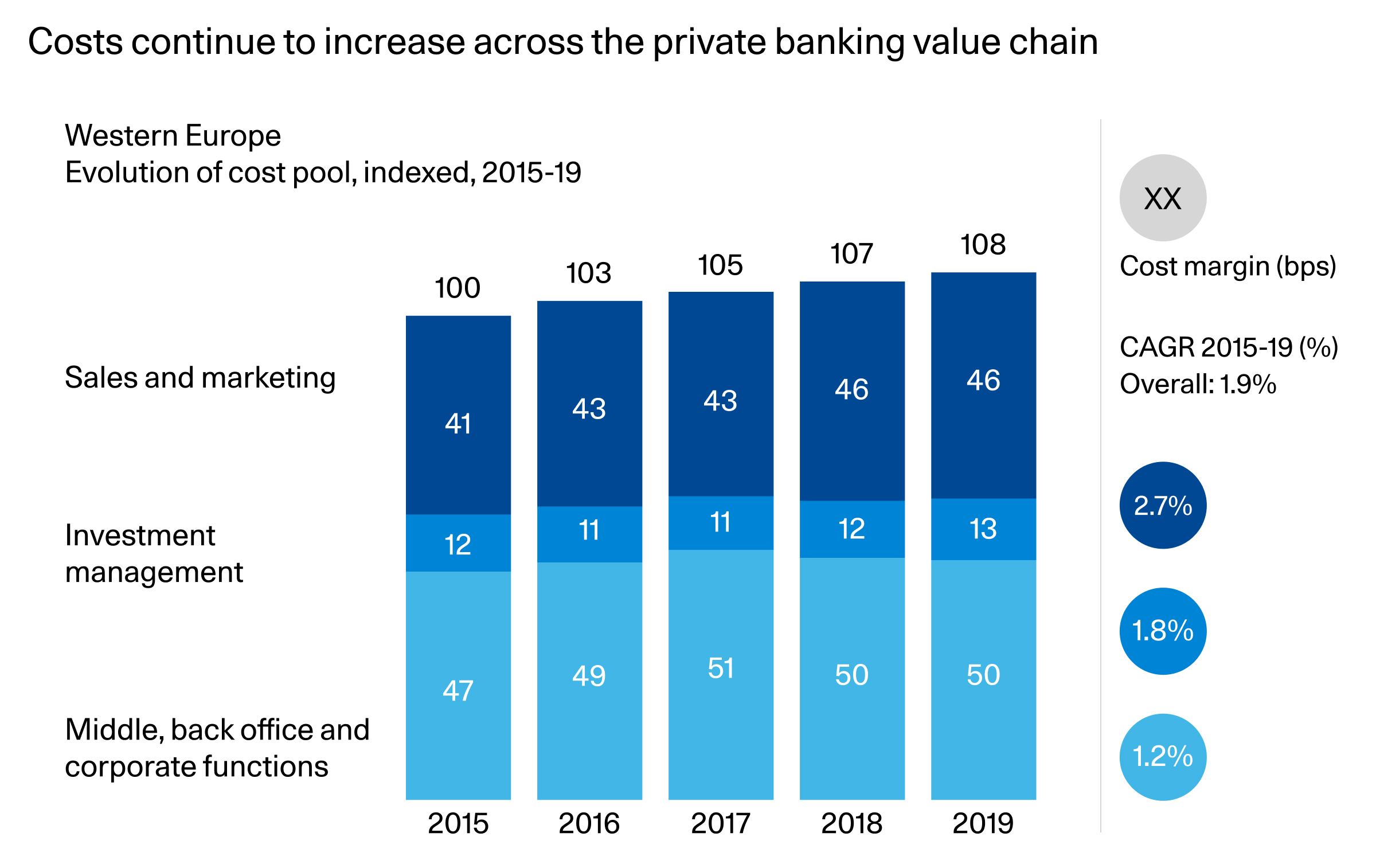

Some reports even point to a stagnation of operating costs – at least, for European banks. As the figure above shows, the indexed costs for middle, back office and corporate functions have even slightly increased since 2015. While the increasing investments in sales and marketing may help to tap into future growth, operational costs continue to be a burden on this journey.

4. Ensure resilience

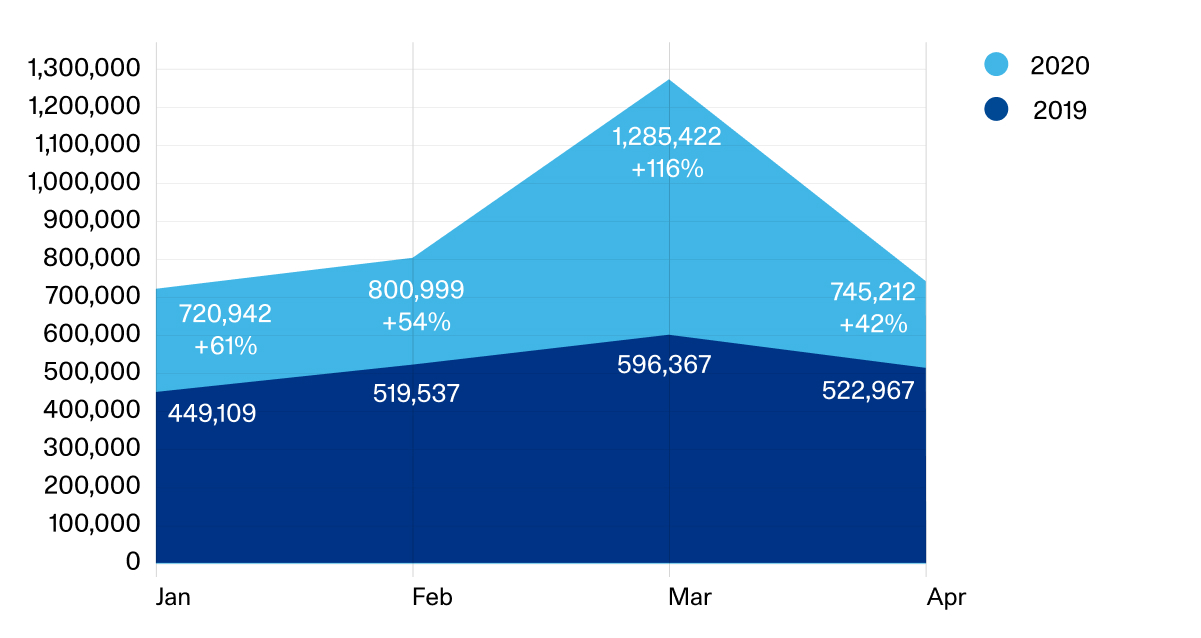

Since the beginning of 2020, we have observed high market volatility, with trading volumes increasing significantly. Despite a 116% increase in March’s transaction volumes and the global market turmoil throughout the pandemic, Avaloq’s BPaaS teams were able to keep the promises made to our clients.

Throughout the first half-year, we maintained a service level adherence of 99% and proved our reliability in a period of extraordinary stress. Stable straight-through processing (STP) rates have secured very low manual handling, thus keeping accuracy levels high. Our proven high and stable STP rates are a major element when it comes to the successful handling of volume peaks. Accuracy rates continued to stay above 99.98% for all BPaaS centres during the first half of 2020.

As a specialized banking operations unit with significant scale, working on a solid cloud banking platform with a high level of automation and standardization, our BPaaS teams proved their resilience in the current crisis. To navigate a crisis like COVID-19 successfully, a team needs a critical mass of specialists to ensure operational readiness. Additionally, it relies on a stable and up-to-date IT platform to handle rising transaction volumes automatically, wherever possible. Both these elements of the Avaloq BPaaS solution proved their value in this uncertain time.

Conclusion

The start of the new decade is the right moment for financial institutions to focus on their core business of serving clients. They will only be able to profit from future growth opportunities with the flexibility to scale. A focus on cost efficiency and operational resilience is essential to navigate a wealth management business through further turbulent years unscathed.

Essentially, this means there is still much untapped potential for banks to improve profits by aggressively targeting operational inefficiencies. The best way to do this is by fully utilizing BPaaS solutions, which can help banks unlock value and increase operational efficiencies like nothing else can.

Ready to take your banking operations to the next level?

Discover how Avaloq's scalable business process as a service can help you focus on serving clients, while increasing operational resilience and cost efficiency.