Liquidly

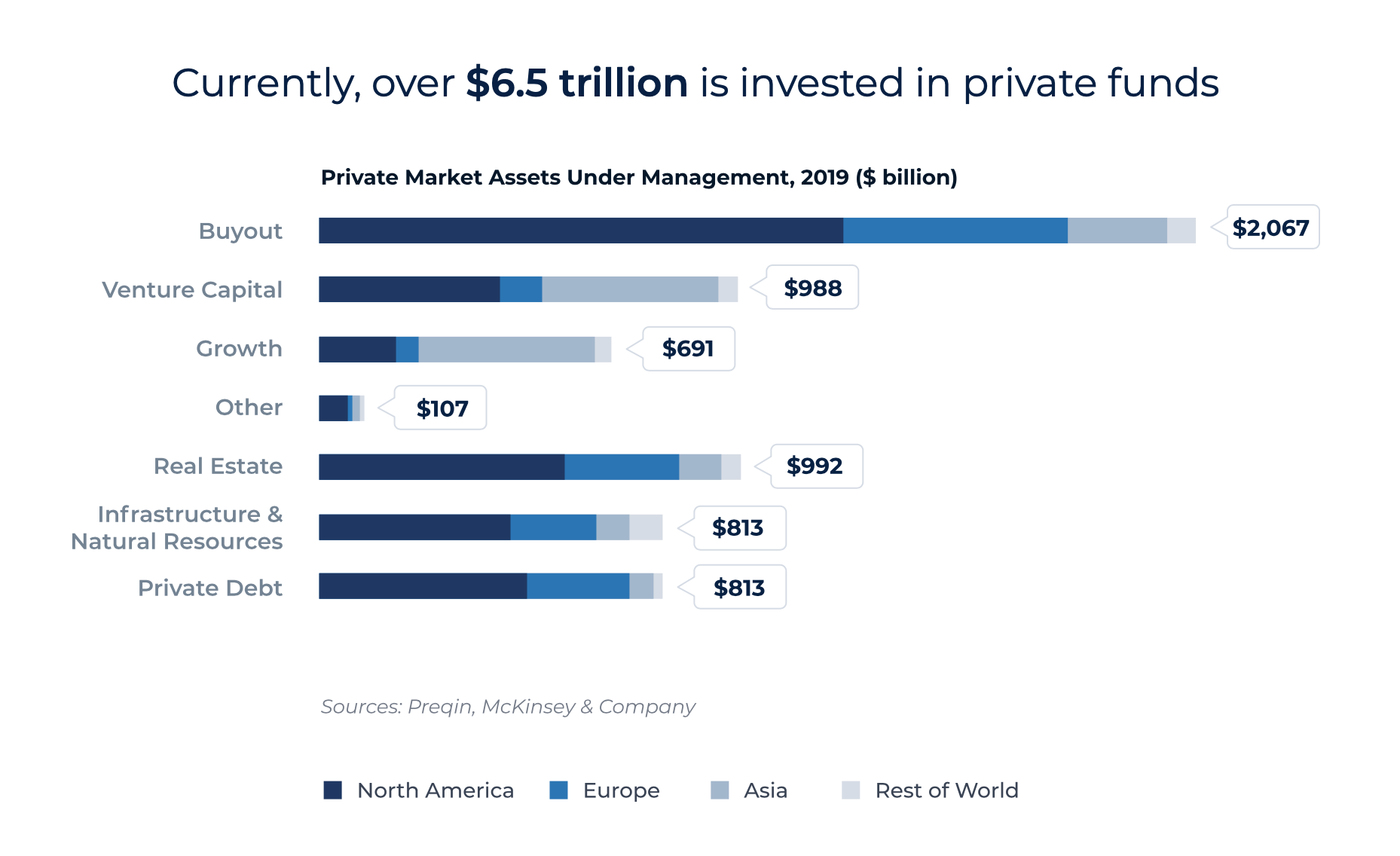

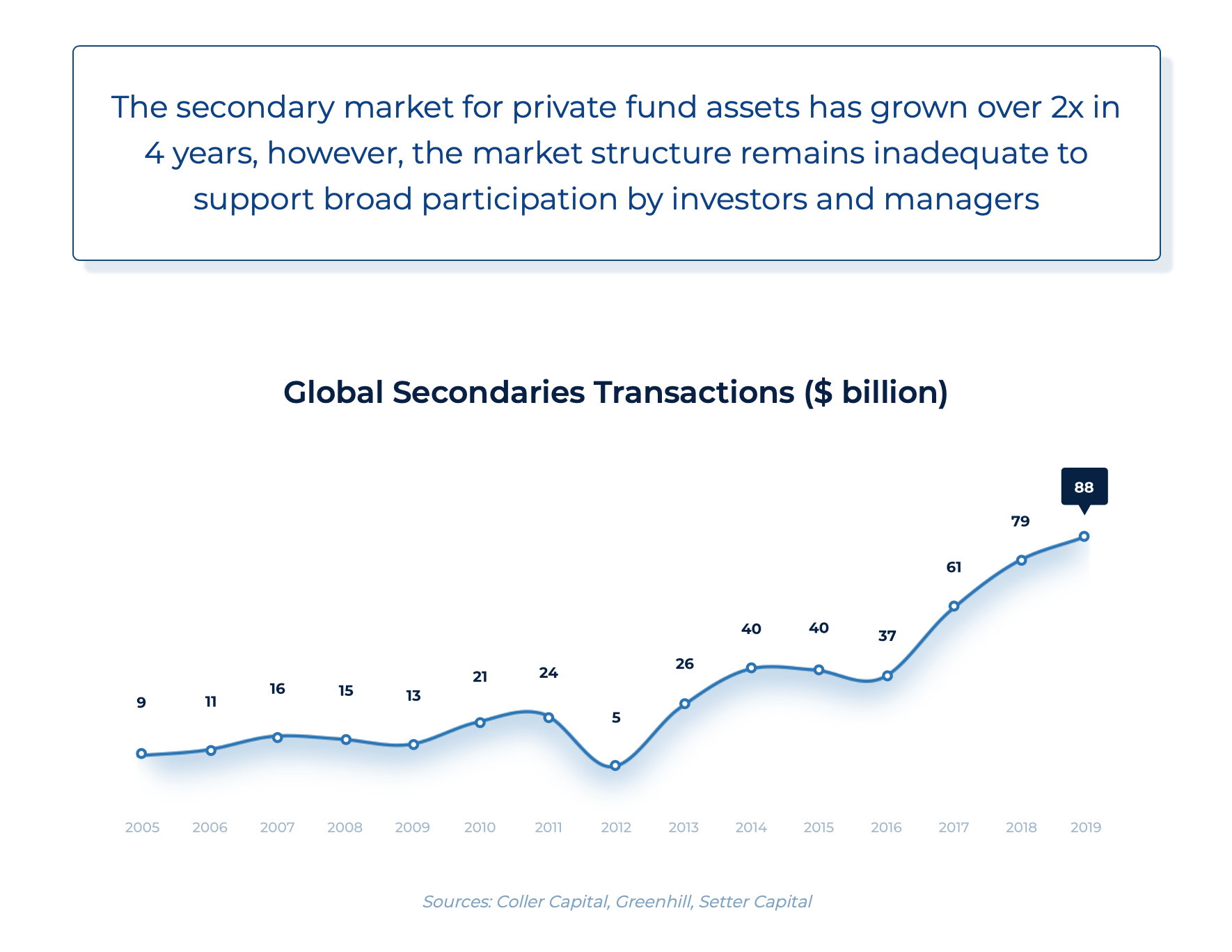

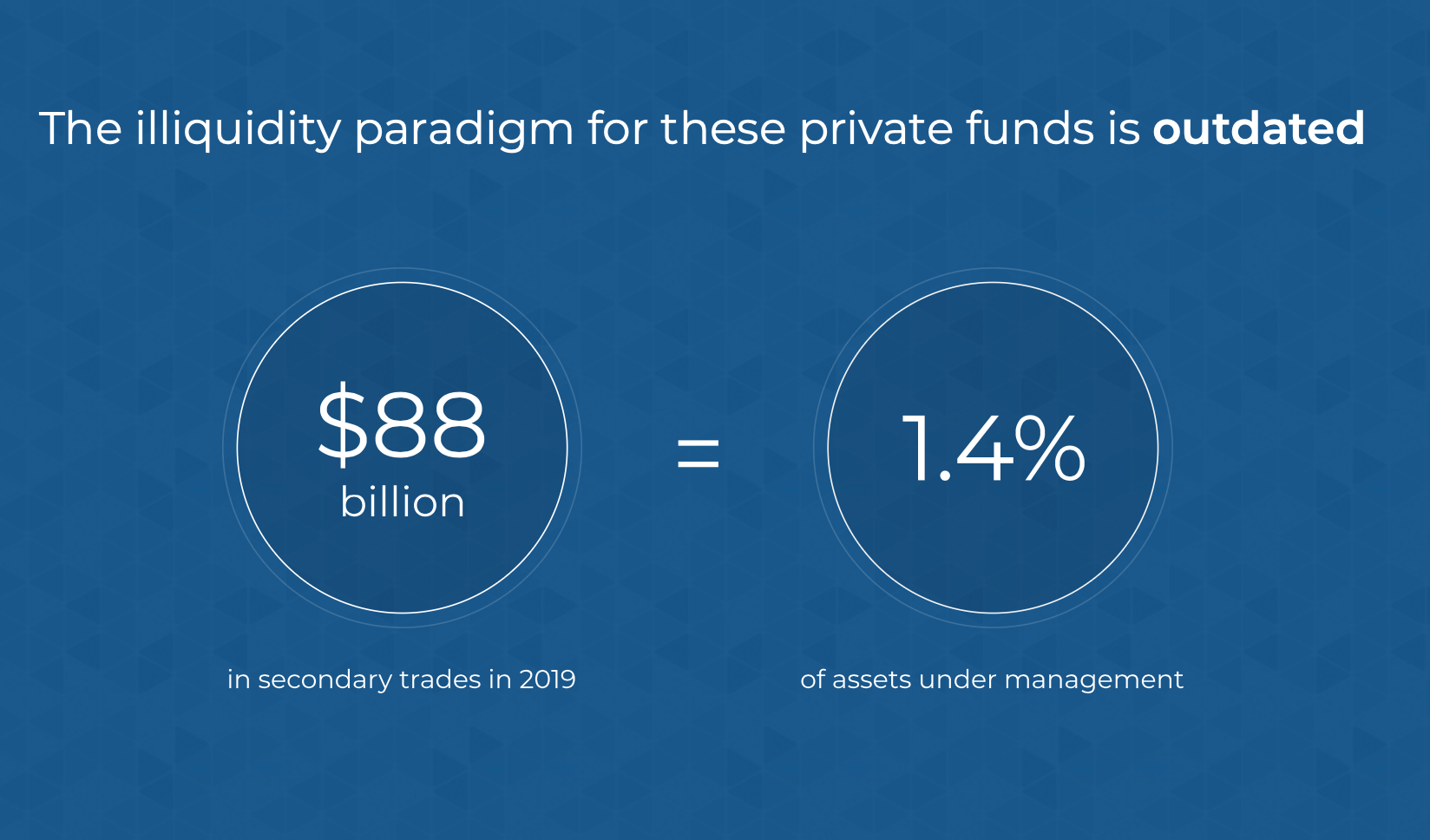

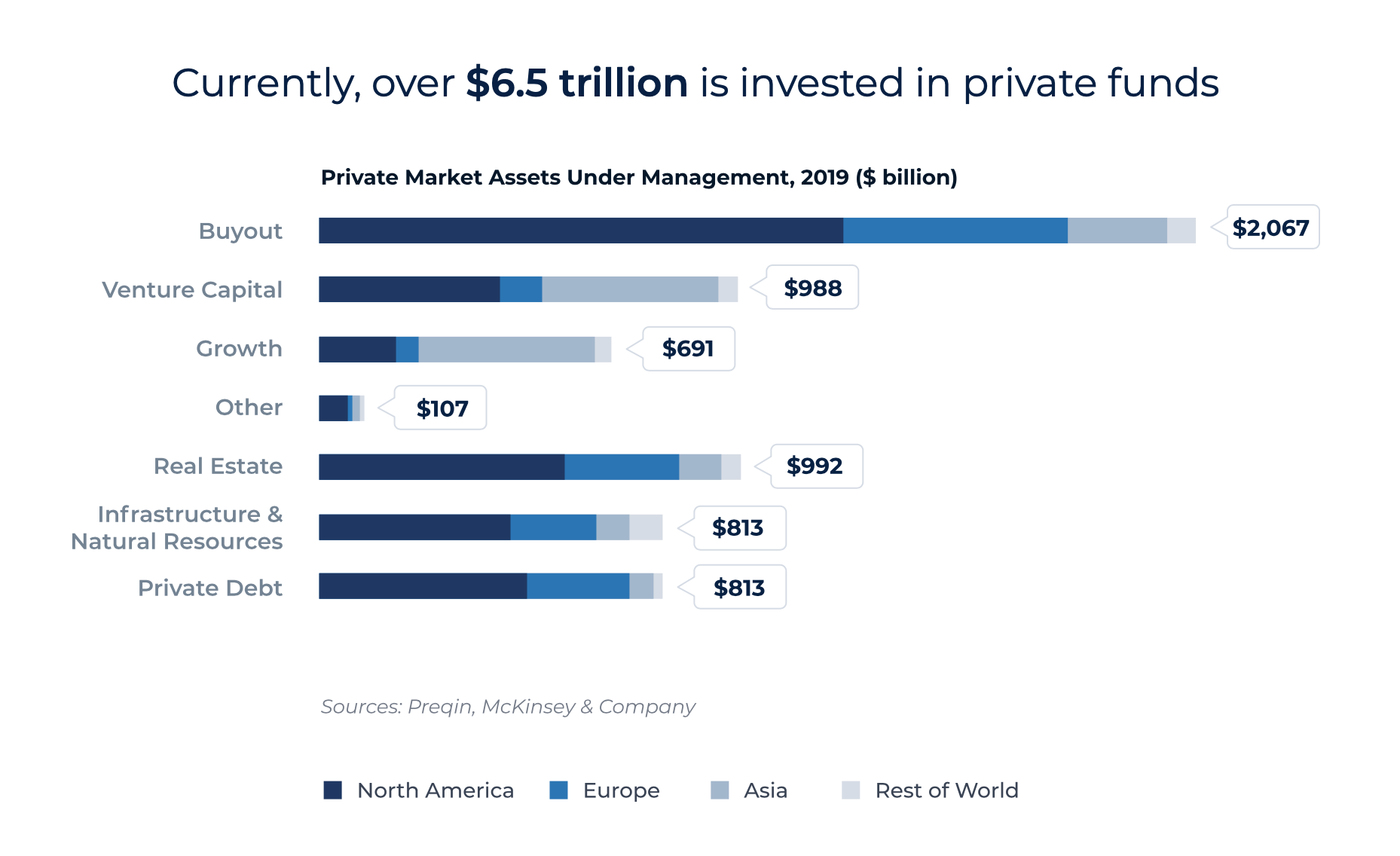

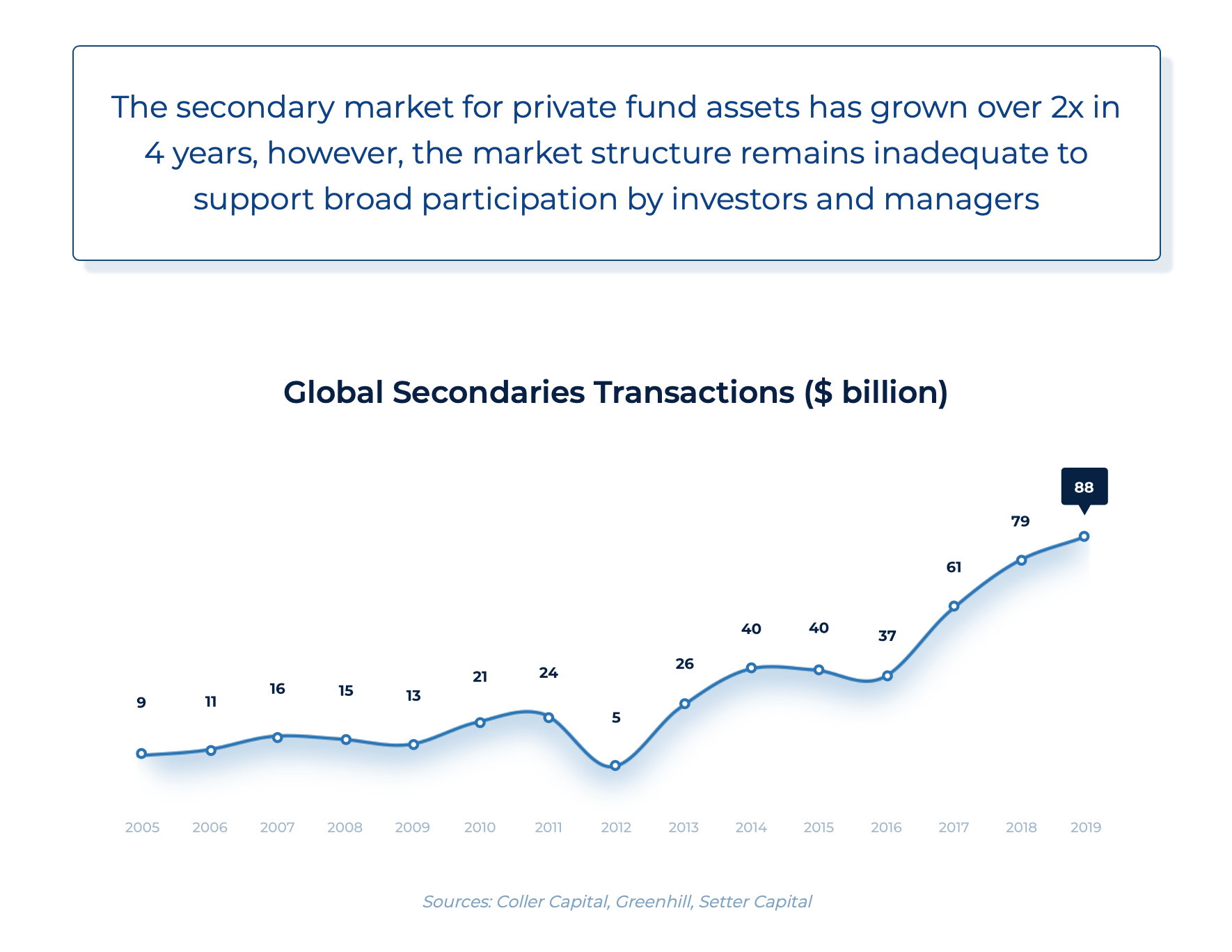

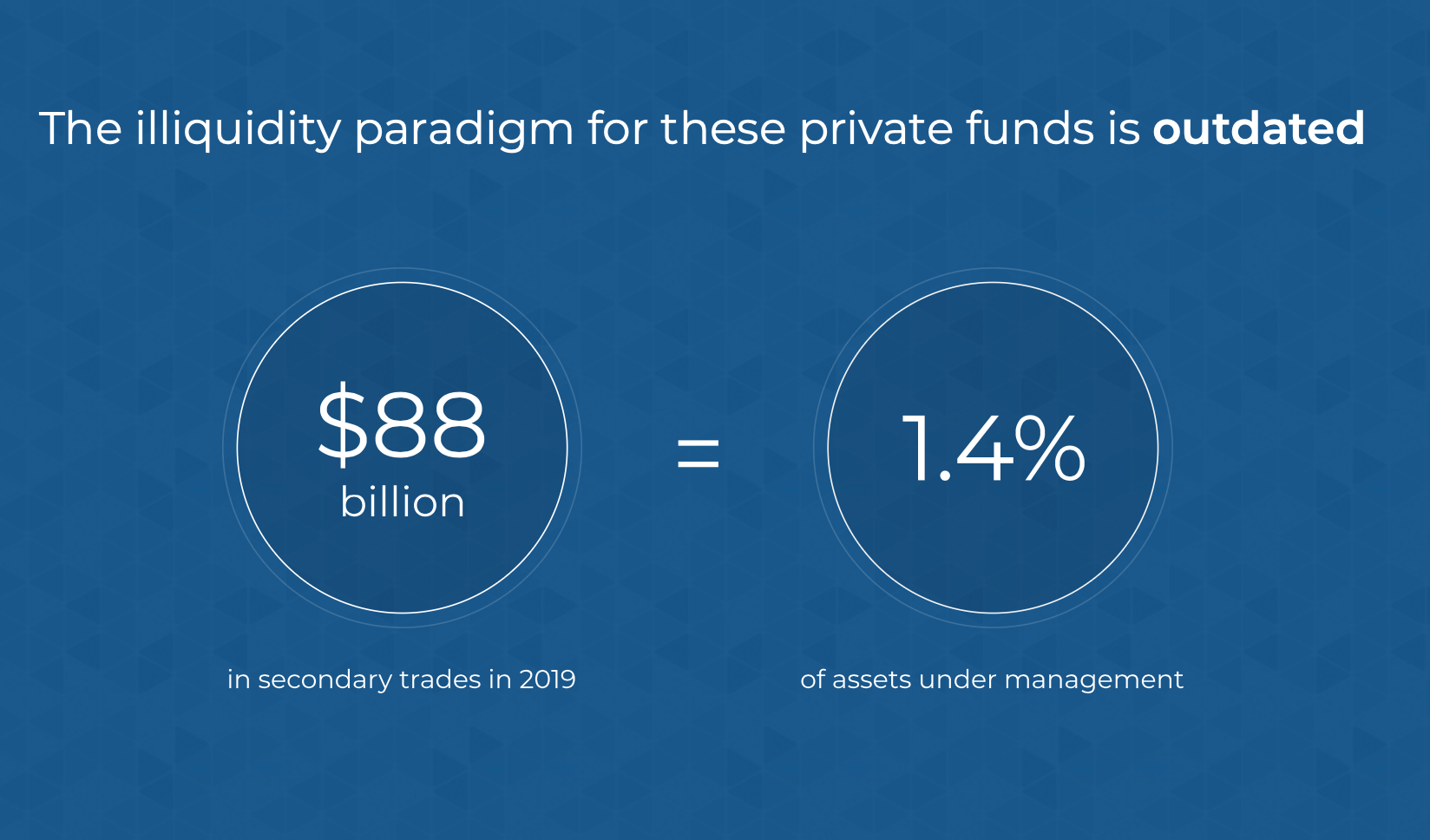

Liquidly builds trading infrastructure for private fund interests.

Key features

- Private Bank-approved: walled-garden trading venue improves diligence process and reduces execution risks

- Secondary and Primary Market Synergies: the option for liquidity will expand investor appetite

- Streamlined Sale Process: standardization of transaction terms and transfer documents

- Two-sided Market: investors could purchase fund interests with a shorter duration in the secondary market

Key features

Key features

- Private Bank-approved: walled-garden trading venue improves diligence process and reduces execution risks

- Secondary and Primary Market Synergies: the option for liquidity will expand investor appetite

- Streamlined Sale Process: standardization of transaction terms and transfer documents

- Two-sided Market: investors could purchase fund interests with a shorter duration in the secondary market

Description

Preview