The ability to leverage advanced technology is crucial for building trust and retaining clients in Switzerland’s wealth management sector. Avaloq’s latest research underscores this need, revealing that nearly one-third (29%) of Swiss investors are willing to switch from wealth managers who fail to modernize and embrace new technology. This article delves into the key findings from our research and outlines the challenges Swiss wealth managers must address to meet clients’ evolving expectations and to remain competitive.

Technology as a driver of trust

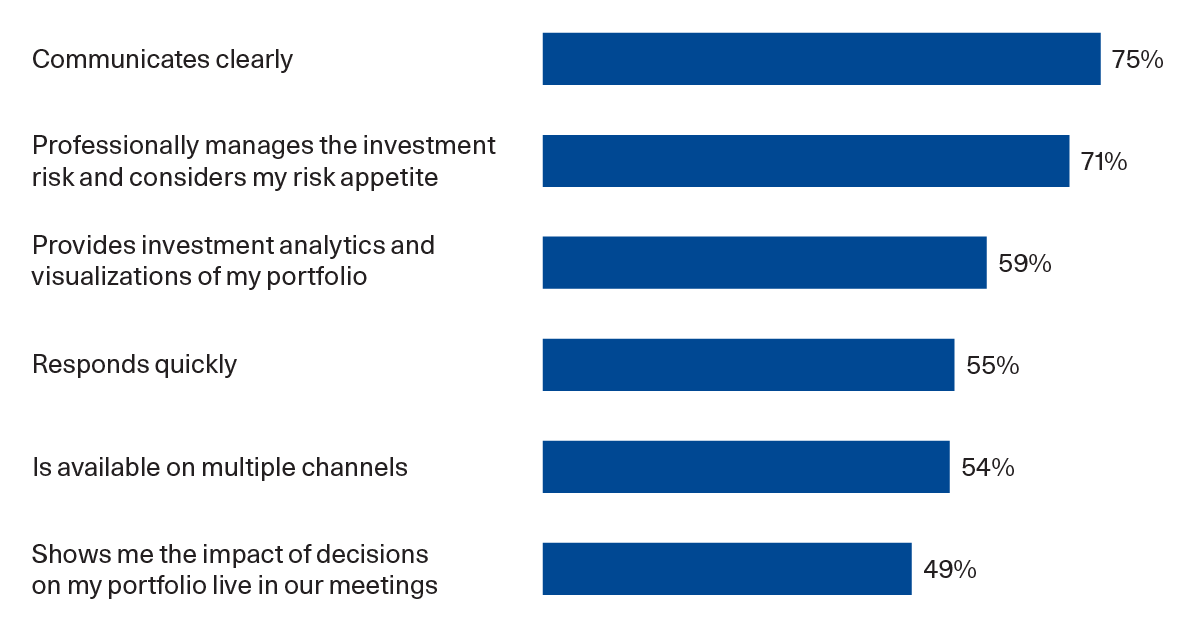

As technology continues to gain acceptance in wealth management, Swiss investors are placing greater importance on tools that enhance transparency and confidence. Our survey shows that 59% of investors consider investment analytics and real-time portfolio visualization essential for building trust with their advisers. Additionally, nearly half (49%) of investors value being shown the impact of their investment decisions on their portfolios during live meetings. Clear communication remains the top factor for establishing trust, with 75% of investors considering it vital.

Figure 1: Top drivers of trust

Q: Please indicate how important each of these elements is for establishing trust in your adviser. (sum of “very important” and “extremely important”)

Challenges faced by Swiss wealth managers

Despite the recognized importance of technology, many Swiss wealth managers struggle with their current systems. Our research reveals that 34% of wealth managers use over ten systems in their work, with 59% saying these systems do not work seamlessly with each other and 39% stating their systems are not well integrated. Additionally, 56% of wealth managers find their systems difficult to navigate, and nearly half (49%) feel that their systems fall short of meeting their needs. This dissatisfaction hinders many wealth managers from fully meeting their clients’ expectations, with 41% of respondents in Switzerland still not using investment advisory technology during live client meetings.

Areas for improvement

Swiss wealth managers highlighted several areas for improvement in investment and portfolio management technology. A significant 63% believe that drafting an investment proposal takes too long, and 56% say it requires too many steps in their current systems. Nearly all respondents confirmed they would benefit from faster, simpler, and more automated portfolio management processes, specifically portfolio monitoring (91%), portfolio construction (91%), and portfolio rebalancing (82%).

Comparing Switzerland to global peers

Despite these challenges, there is a silver lining. Switzerland compares favourably to global peers when it comes to the overall state of wealth management technology. Notably, 55% of Swiss industry professionals feel their portfolio management technology supports them in managing mandates at scale, compared to 32% globally. Additionally, the proportion of respondents in Switzerland who consider their systems to be outdated is significantly lower at 32%, compared to a global average of 44%.

The path forward: embracing modernization

By embracing modernization and integrating advanced technology into their operations, wealth managers can not only meet but exceed client expectations. This transformation will enable them to offer more personalized and efficient services, fostering stronger client relationships and trust. The ability to scale personalized services to new client segments will also open up new avenues for growth. As the financial landscape continues to evolve, those who adapt and leverage cutting-edge technology will be well-positioned to lead the industry and set new standards in wealth management.

Access the full report and gain deeper insights

For a comprehensive analysis and additional insights at both regional and country levels, download the “Avaloq wealth insights 2024” report now. Learn how you can leverage these trends to stay ahead in the wealth management industry.